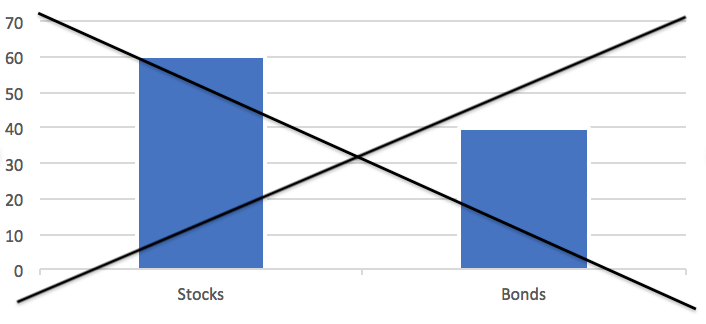

Monday Morning Millionaire Program members appreciate the importance of asset allocation for sound investing. Many use the 60/40 ratio personally.

Recently, the influential Bank of America declared the end of the 60/40 portfolio. As a result, an Internet search for “end of the 60/40 portfolio” generates nearly half a million hits.

Forbes, U.S.News, CNBC, Business Insider, A Wealth of Common Sense and many others weighed in on the subject.

Should Monday Morning Millionaire Program members be concerned?

Let us look at the 60, first.

In most of the articles published, the 60% represents stocks. Picked stocks.

Monday Morning Millionaire Program members know that 1/2 of stock pickers are correct and the other half are wrong. It cannot be any other way. Members don’t pick stocks but invest in the American economy as a whole by using an exchange-traded fund (ETF) that represents that economy. They do so by using an

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us