Greetings, everyone,

You will enjoy the presentation which follows.

The presentation is about 30 minutes long, and you could learn something valuable from watching it.

Contact me if you have questions.

I send my best personal regards,

Milan 😃

Greetings, everyone,

You will enjoy the presentation which follows.

The presentation is about 30 minutes long, and you could learn something valuable from watching it.

Contact me if you have questions.

I send my best personal regards,

Milan 😃

Greetings, everyone,

You will enjoy the presentation which follows.

The presentation is about 30 minutes long, and you could learn something valuable from watching it.

Contact me if you have questions.

I send my best personal regards,

Milan 😃

Greetings, everyone,

You will enjoy the presentation which follows.

https://www.youtube.com/watch?v=Y_PzLr_Ign4

The presentation is about 30 minutes long, and you could learn something valuable from watching it.

Contact me if you have questions.

I send my best personal regards,

Milan 😃

Top-earning Wall Street/Bay Street bankers make in a week what the average dentist earns in three years. Yes, “in a week” versus “in three years”—this is not a misprint or a typo.

Furthermore, investment bankers budget millions for fines related to their misbehavior, much like you and I budget for groceries, rent, or holidays. But how do they misbehave? They engage in market manipulation, insider trading, providing misleading information about securities, omitting crucial information about securities, stealing customers’ funds or securities, and other activities that harm investors if left undiscovered.

Who pays for these outrageous incomes and exorbitant fines? Look in the mirror. It could be you.

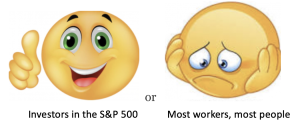

But does it have to be you? Can you avoid being on the hook? Can you make money in the stock market? Over the long run, about 90% of retail investors lose money.

An exchange-traded fund (ETF) that tracks the U.S. economy has been the best investment for over 100 years. While individual investments might occasionally outperform, nothing generally surpasses the U.S. economy. Yet, about 90% of retail investors still lose money.

So, what does an investor need to do to match the U.S. economy’s performance? There are six key principles to follow:

These six principles constitute rules-based investing, which is consistently effective. The alternative, judgment-based investing, is wrong at least half the time.

Would you drive knowing there is a 50% chance of an accident? If not, avoid buying individual stocks and timing the market.

Investing following these six rules requires very little time. “The best returns” and “very little time”—who needs more?

Greetings, everyone,

You will enjoy the presentation which follows.

The presentation is about 30 minutes long, and you could learn something valuable from watching it.

Contact me if you have questions.

I send my best personal regards,

Milan 😃

Greetings, everyone,

You will enjoy the presentation which follows.

https://www.youtube.com/watch?v=wVNfFDEFWNY

The presentation is about 40 minutes long, and you could learn something valuable from watching it.

Contact me if you have questions.

I send my best personal regards,

Milan 😃

The put/call ratio for the U.S. market is negative for several weeks. Interpreting this ratio correctly can be complicated.

To review, a put option gives an investor the right to sell an asset at a preset price called the strike price. If the asset drops below the strike price, the investor makes money.

A call option gives an investor the right to buy an asset at a preset price called the strike price. If the asset rises above the strike price, the investor makes money.

If investors are buying more puts than calls, it indicates a bear market.

If they are buying more calls than puts, it indicates a bull market.

Unlike the put/call ratio, which can be difficult to interpret, an inverted yield curve always accurately forecasts recessions. We should watch for an inverted yield curve; the market could drop into bargain-buying territory.

Yesterday, I met with our federal government member, Terry Dowdall MP, to encourage legislation allowing Canadian investors to sell cash-secured puts in their tax-advantaged (registered) accounts. You can see my reasoning below.

How Canadian Investors Can Earn More Money.

How the Canadian Government Can Collect More Taxes.

Most Canadians have one or more registered [tax-advantaged] accounts. They can enhance the income in these accounts by using derivatives. They can write (sell) covered calls on any securities they have in these accounts. Further, they can earn more money by writing (selling) cash-secured puts on these securities. However, they are not allowed to do so in tax-advantaged accounts in Canada.

American investors are allowed to do so in their tax-advantaged accounts.

History shows that securities held in tax-advantaged accounts in an appropriate asset allocation over the long term have been the investor’s best way to grow savings. They will likely remain so for many years if investors use derivatives correctly.

What is an appropriate asset allocation? How can investors best use derivatives?

An appropriate asset allocation can be 50/50 (50% in securities and 50% in cash or near-cash, such as money markets). 60/40, 55/45, and similar allocations also work.

Asset allocation accounts for the largest share of portfolio returns.

It is essential to have a high percentage of a portfolio in cash or near-cash and return to that allocation whenever market movement changes it.

How can investors best use derivatives?

Canadian investors can best use derivatives to increase their returns even more if allowed to write (sell) cash-covered puts. The federal government would collect more taxes when investors withdraw money from these accounts.

The federal government should consider the benefits of allowing investors to write (sell) cash-covered puts in registered accounts.

It is an excellent example of a win/win case.

Greetings, everyone,

You will enjoy the presentation which follows.

https://www.youtube.com/watch?v=i3-XxALqzo4

The presentation is about 30 minutes long, and you could learn something valuable from watching it.

Contact me if you have questions.

I send my best personal regards,

Milan 😃

By Leah Nylen  “

“

When private equity firms buy out health-care facilities only to slash staffing and cut quality, patients lose out,” said FTC Chair Lina Khan. “Through this inquiry the FTC will continue scrutinizing private equity roll-ups, strip-and-flip tactics, and other financial plays that can enrich executives but leave the American (and Canadian) public worse off.”

If you are concerned, call Timothy Brown, CEO of ROI Corp. 416-520-7420