At the beginning of a new year, we see a large number of market “experts” predicting the stock market rest of the year. At best, they make for amusing reading. To quote Niels Bohr, it is dangerous to prophesy, especially about the future.

We previously wrote about forecasting and predicting here, here and here.

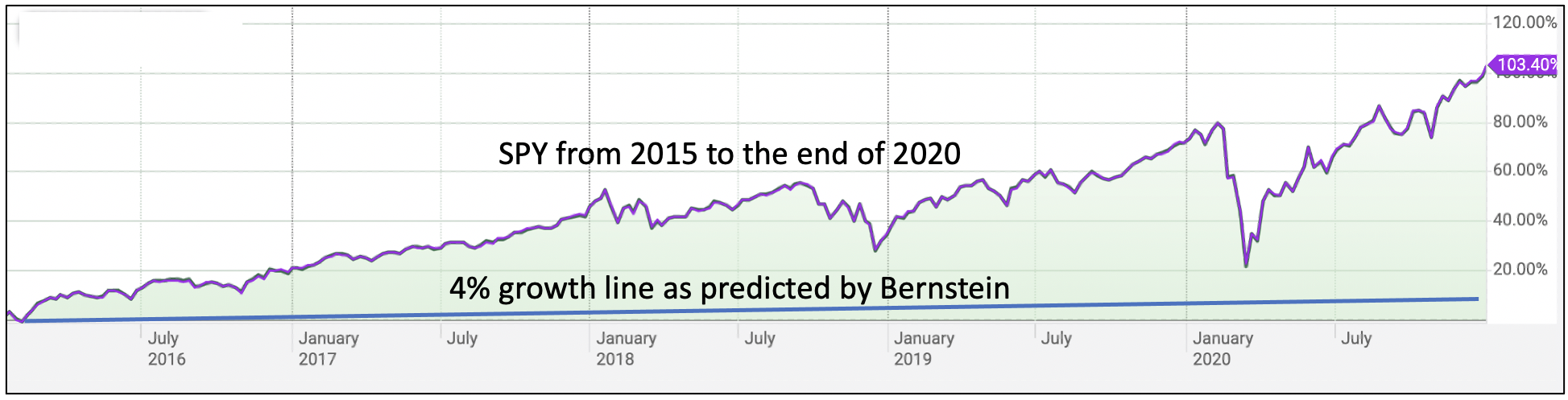

In March 2015, renowned market theorist and neurologist William Bernstein stated: “I would say that the expected return of a balanced portfolio is the lowest it’s been in financial history. We’re looking at 3 or 4 percent on stocks….“

If there are degrees of wrong, Bernstein could not have been more wrong. Investors acting on his comments missed out; the expected return of a balanced portfolio turned out to be among the BEST it’s been in financial history.

Looking at “degrees of wrong”, here is the other end of the scale.

Irving Fisher, seen as “the greatest economist the United States has ever produced” by respected, Nobel Prize-winning colleagues, is largely remembered today for saying just before the Wall Street Crash of 1929, that the stock market had reached “a permanently high plateau”.

Some predictions are highly reliable. For example, market experts will continue to make predictions that will be unreliable much of the time.

Why do they keep doing it?

What has been the best way to invest?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us