One of our members, an investment banker with an MA in economics and an MBA, an ultra high net worth successful investor, recently bought some shares of Palantir. The link below leads to details on the company.

Following the link will allow one to be better informed about Wintel Wars, DARPA programs, Europe’s GAIA-X and more. It might, but probably won’t improve one’s investment results.

Our member spends a good part of the day, every day managing his portfolios; Palantir is a small percentage of his portfolios.

…good part of the day…, …a small percentage…?

How do these two align with the Monday Morning investment philosophy? Do they get better results than the Monday Morning investment philosophy? What about better results for the time spent?

Investors who have the interest and who are investment bankers with an MA in economics and an MBA, might be able to outperform the market. Few investors qualify.

Nevertheless, we could teach a high school student in less than an hour how to equal the market.

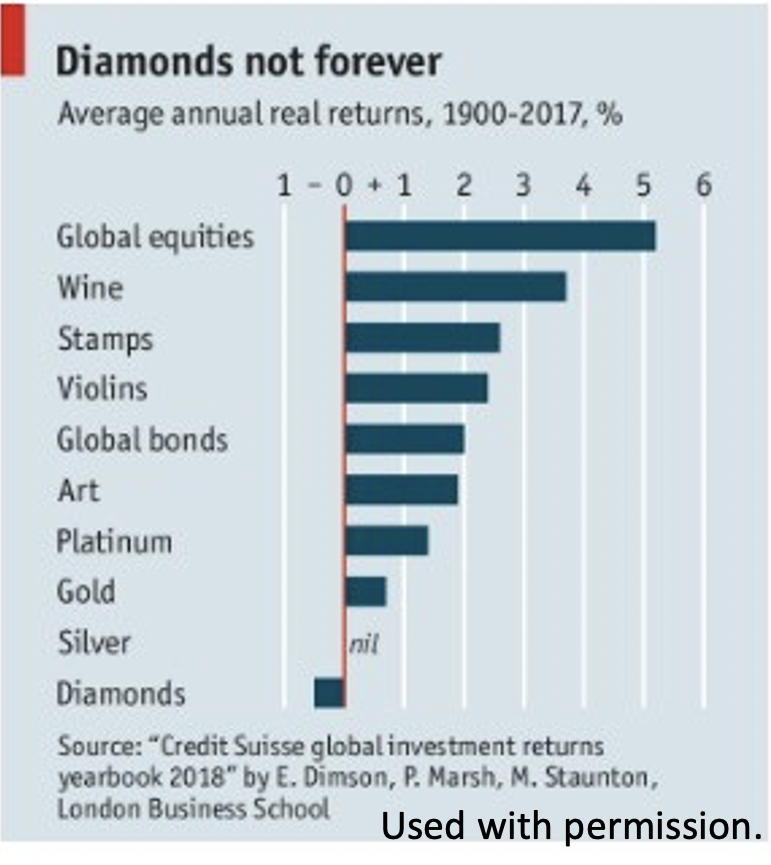

Unless we are cherry picking, the market has provided investors with the best returns for over 100 years, as you can see in the chart above. Yet, equalling the market is a feat which a few investors achieve. SPIVA shows that in a convincing manner.

To review why that is so, go here, here and here.

Warren Buffett’s mentor Benjamin Graham once said, “To achieve satisfactory investment results is easier than most people realize.”

And what does it take?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us