One of our members, a Ph.D. in the humanities who sold his exceptionally profitable business a few years ago, recently stated: “If everything is as easy as you suggest, there would be a great many wealthy people around.”

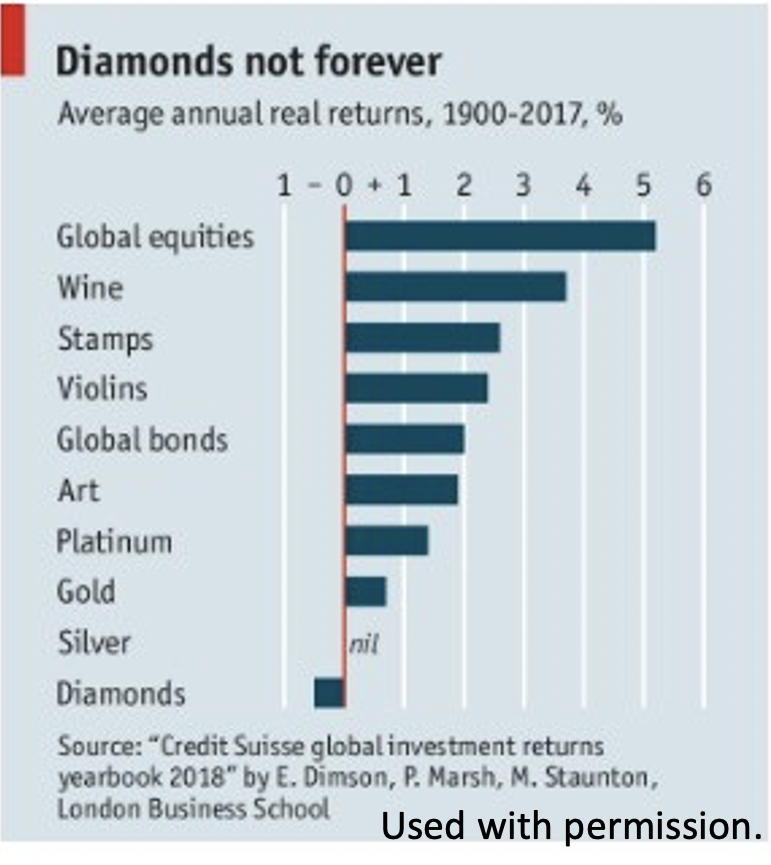

For over 100 years, global equities have been the best place to invest, as the chart below shows.

In less than one hour, we can teach a high school student how to equal the market. Nevertheless, very few investors manage to do so. Our member is right. There are very few wealthy people around.

Dalbar Inc., which analyzes investor market returns, regularly shows that average investors earn below-average returns.

Why is that?

Simply put, the conflict of interest between Wall Street and Main St. is enormous. On 3.10.21, we posted an article about predictions by Wall Street experts. We mentioned Credit Suisse, BlackRock, Grantham, Mayo, Van Otterloo, J. P. Morgan, Morningstar Investment Management, Research Affiliates and Vanguard.

Expect for Grantham, Mayo, Van Otterloo, we found SEC disciplinary action against every one of the others. Every one! Fines in the millions! They were fined for market manipulation, insider trading, misleading information about securities, the omission of important information about securities, stealing customers’ funds or securities and other crimes. Nobody knows how much they actually do get away with.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us

The Monday Morning Millionaire Program supports do-it-yourself (DIY) investors which I have been for over 50 years. About my team and me