Lake Bled, Slovenia

The most predictable, evidence-based way to grow savings it to decide on your core portfolio asset allocation between a US index-tracking ETF and cash equivalents and deposit a minimum of 10% of your earnings (more is better) into it until retirement. At retirement, withdraw 4% annually and live happily ever after. You will never run out of money; however, you must be prepared to tolerate the market’s fluctuations.

The best three exchange traded funds (ETF’s) to track the S&P 500 are the S&P 500 ETF (symbol SPY), Vanguard S&P 500 (symbol VOO) and the iShares S&P 500 (symbol IVV) and other similar ones. Each is an excellent approximation of the U.S. economy, the strongest in history. This core portfolio will allow you predictably to outperform over 90% of professionally managed funds in addition to saving you a year’s income in fees.

This is predictable, boring stuff. Its only cocktail party conversation value is to mention my hundred thousand-dollar bet payable by the loser to the winner’s favorite charity claiming that an investment in SPY will beat any other investment over the course of a decade. Cherry picking with hindsight does not count.

For members interested in excitement and the possibility of doing even better, an “explore” portfolio is appropriate. This portfolio breaks the rules. It ignores all the seven habits of highly successful investors except the first. (Don’t use the services of an adviser to make investment decisions).

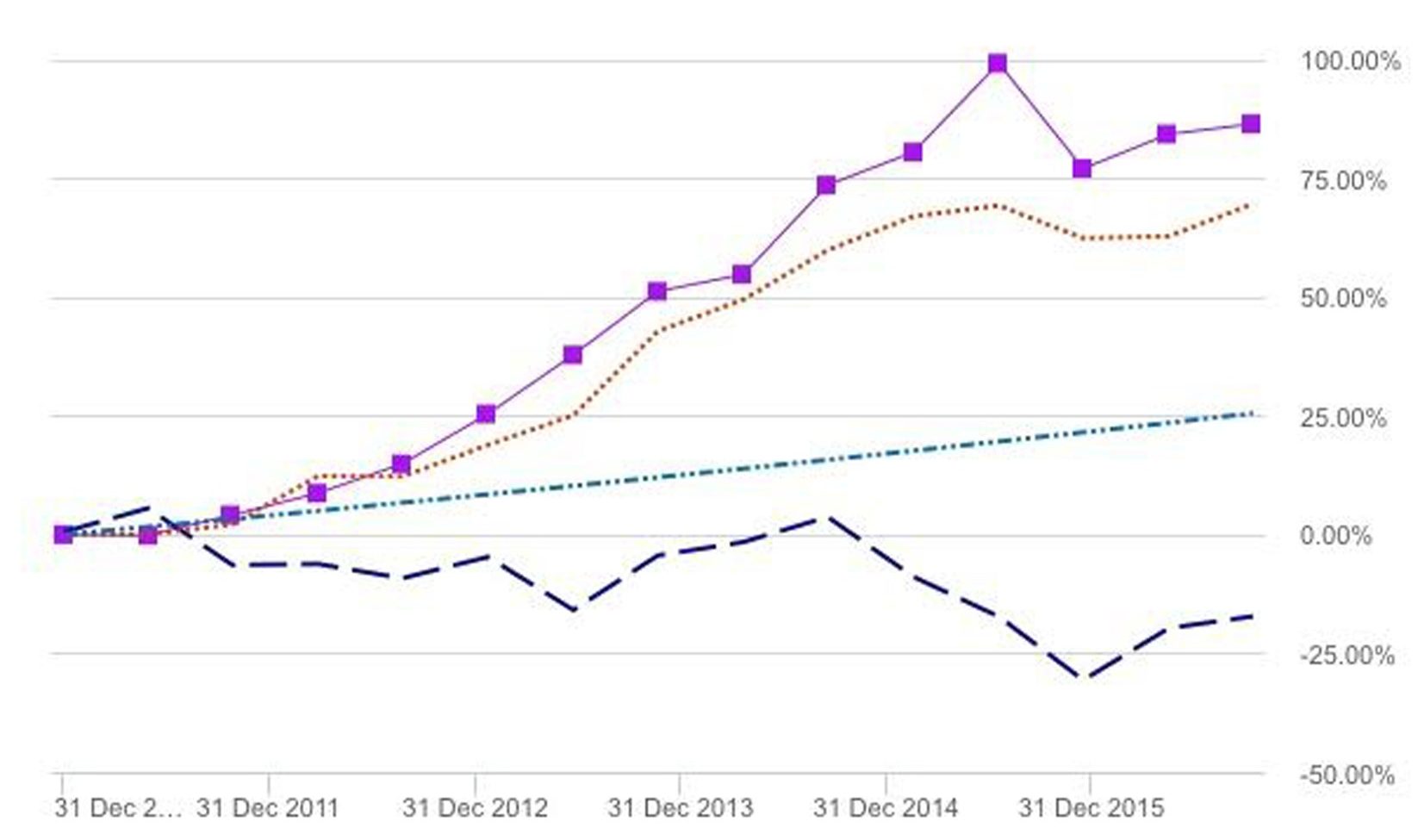

The chart on the cover of Monday Morning Millionaire Ed.2 shows the six-year track record of such investing, writing covered calls on SPY.

Top line: our “explore” portfolio

Line below: the S&P500

Straight line: 4% annual growth

Bottom line: Canadian market performance

Collectively, calls and puts are called derivatives. If you are interested in managing an “explore” portfolio, understanding derivatives is useful. Both Wikipedia and Investopedia provide excellent explanations. Getting to understand them can be demanding. Investors interested in positive, predictable and evidence-based results don’t need and “explore” portfolio. All investors should keep my hundred thousand-dollar bet in mind.

Major bankruptcies have resulted from being involved with derivatives. Nevertheless, derivatives investing can be done safely and profitably. The size of your “explore” portfolio should be one that you are comfortable with, keeping in mind that it is risky. Rosi’s and mine makes up 20% of our market holdings.

Here then, are the rules for safe derivatives investing in your “explore” portfolio.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us