On Feb. 3 of this year we posted a blog about how to read effectively. Now, we will review the finance books that investors might want to read effectively. (From A Wealth of Common Sense by Ben Carlson July, 2020)

Here is Carlson’s list:

The Intelligent Investor by Benjamin Graham

One Up on Wall Street by Peter Lynch

Reminiscences of a Stock Operator by Edwin LeFevre

Where Are the Customers Yachts? by Fred Schwed

Common Stocks and Uncommon Profits by Philip A. Fisher

The Black Swan by Nassim Taleb

The Money Game by Adam Smith

A Random Walk Down Wall Street by Burton Malkiel

The Alchemy of Finance by George Soros

Liar’s Poker by Michael Lewis

Stocks For the Long Run by Jeremy Siegel

The Little Book of Common Sense Investing by Jack Bogle

When Genius Failed by Roger Lowenstein

Against The Gods by Peter Bernstein

Winning the Loser’s Game by Charles Ellis

Your Money & Your Brain by Jason Zweig

Simple Wealth, Inevitable Wealth by Nick Murray

The Millionaire Next Door by Thomas Stanley

Poor Charlie’s Almanack by Charlie Munger

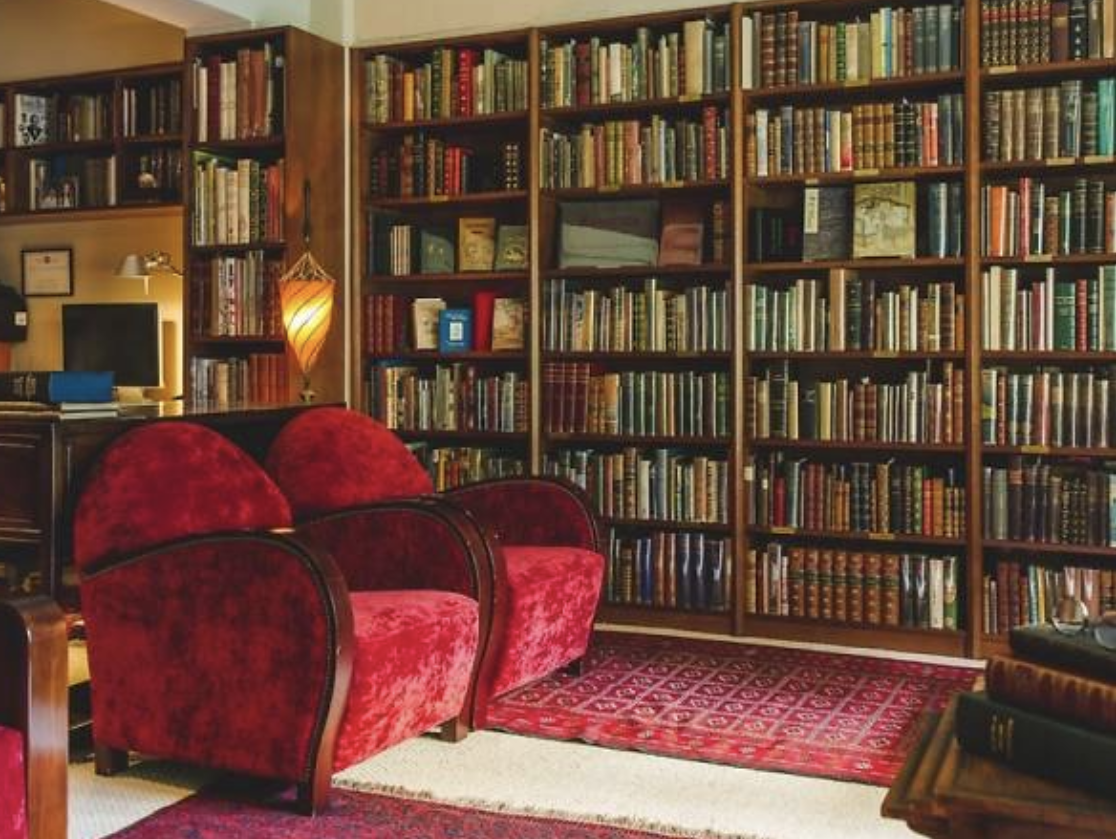

I own them all, have browsed through them all and agree with Carlson’s choices. He does not mention Security Analysis by Graham and Dodd, however.

Every one of the authors mentioned above has studied or taught this 760-page book written nearly 80 years ago by professors Benjamin Graham and David Dodd of Columbia Business School. This influential book is now in its sixth edition and establishes the principles of value investing.

Collectors can get a signed, original version for $US48,000.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us