The Monday Morning Millionaire Program has had a significant percentage membership increase this February over February 2018, so far. This blog will be an overview of the Monday Morning Millionaire Program approach to investing for them and a review for older members.

First, the Monday Morning Millionaire Program encourages investing in the US stock market in a specific way. (See the habits of Monday Morning Millionaire Program members, described below.)

Why the stock market?

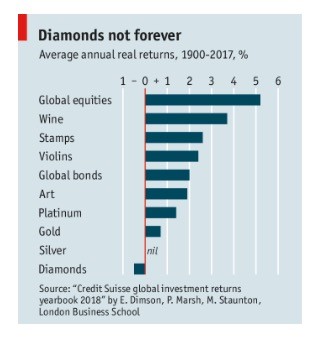

The 117-year chart of real returns below shows why. In addition to good returns there are constantly quoted prices, liquidity, low transaction costs (we can practically ignore them today) and good record keeping provided by brokers. These make sensible stock market investing an excellent way to save for long-term objectives. (Retirement, children’s and grandchildren’s higher education, and more.)

Why the US stock market?

There are 16 stock markets in the world with a capitalization of over a trillion dollars; they all have the characteristics described above. Today, we can easily invest in any of them but the US market has the best track record.

Any security prospectus will tell us that past performance is no guarantee of future results, but on a macro level, past performance is a good guide. For example, on a macro level, we can safely bet that Malawi will not perform as well economically as the US in the near future. However, on a micro level, a Malawi company might discover a vast tantalum deposit making it a better investment than the overall US market over the short run.

On a macro level, the US market has the best performance of any. Empires have a 100% failure rate, but the failure of the US empire is nowhere in sight yet.

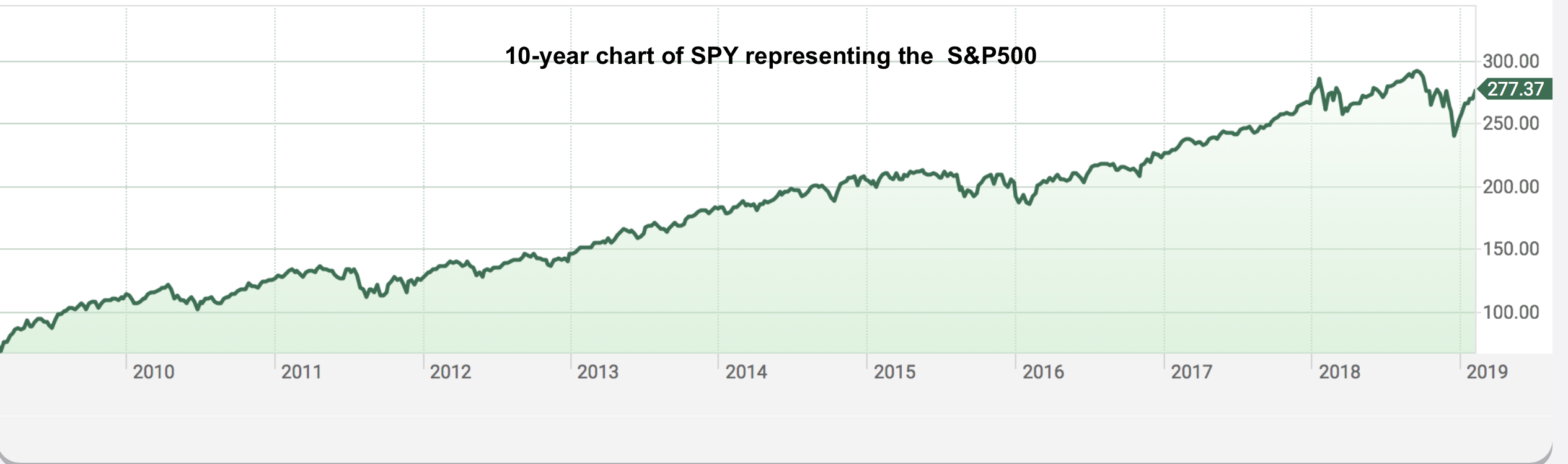

Nothing in investing is more straightforward than equaling the US market as represented by the S&P500 (minus small transaction fees). Practiced within a sensible asset allocation regime, once set up, investing this way takes no more than 15 minutes per week. The Monday Morning Millionaire Program shows how. Few investors need professional help to invest this way.

However, nothing is more difficult than beating the S&P500 over a market cycle (peak to trough to peak). Few investors and advisers do.

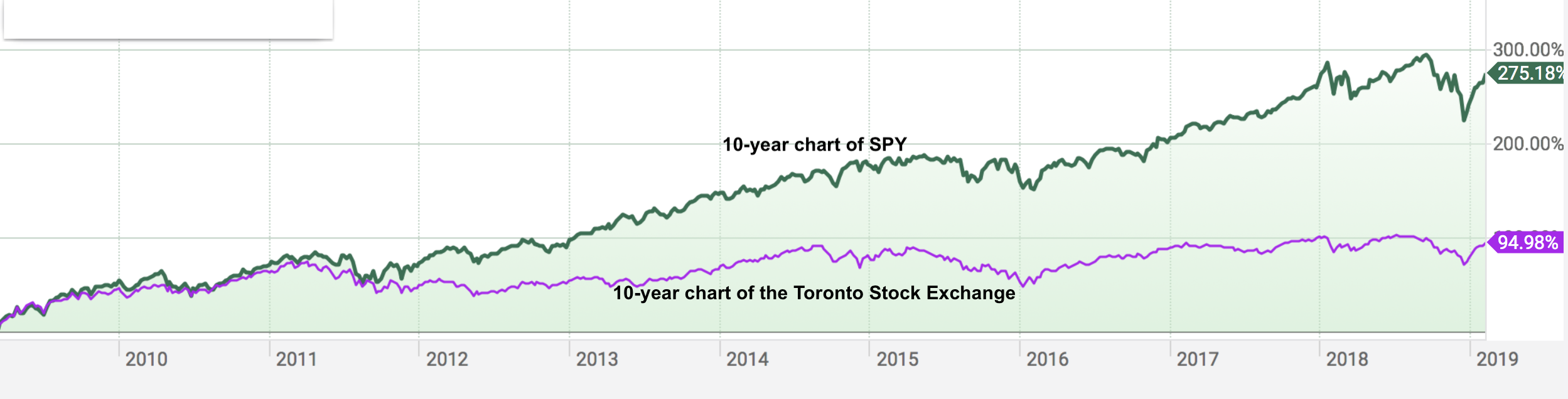

Many of our new members are Canadians. Over the last decade, the performance of Canada’s major market (Toronto Stock Exchange), pales in comparison to US markets. That will likely remain so.

Why?

Canadian markets are focused on financial and resource sectors only. The US markets represent financials and resources too, but in addition, there are materials, industrials, consumer discretionary, consumer staples, healthcare, information technology, telecom and real estate — the entire spectrum of the economy. Investing in the US generally is more promising.

Let us review the habits of Monday Morning Millionaire Program members, i.e. habits of highly successful investors.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us