First, note that the Monday Morning Program recommends passive investing — watching grass grow, watching paint dry. What we write about below is NOT passive investing. However, our members with a moderate risk tolerance level have been doing it, often safely and successfully.

According to Morningstar, the shares of vaccine manufacturing companies, Amgen Inc (AMGN), Emergent BioSolutions (EBS), Moderna (MRNA), Novavax (NVAX), Regeneron Pharmaceuticals (REGN) and others are overvalued by amounts ranging from 11% to 71%.

Investors are buying shares in these overvalued companies because they expect them to shoot up in price once their vaccines in development get regulatory clearance.

NVAX is overvalued by 71% – the greatest amount of any of them. Is that because investors have the greatest expectations from this company?

Why do investors (mostly speculators, really) buy calls on a security? (Our members only sell and rarely buy calls and puts.)

To benefit from the growth of a board lot of NVAX (100 shares), investors need about $9,350.00 to buy the shares outright at today’s prices. To benefit from that growth, investors need only about $300 to buy a call option on one board lot. That gives them the right to take advantage of the same growth.

If there is any!

If no growth takes place before the expiry date of the call, investors lose their money entirely.

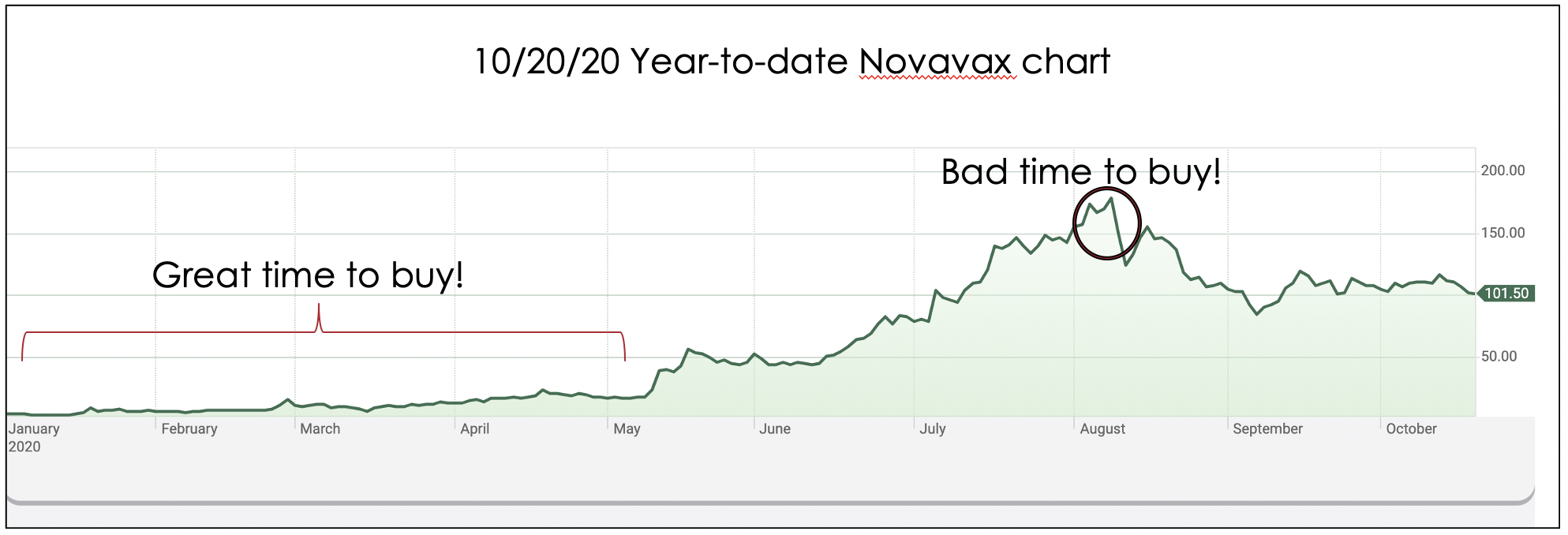

Note that year-to-date, NVAX has gone up 2,3721% (not a misprint) while the S&P 500 has gone up 6.57%. But over the last 3 months, NVAX has declined 32.84% while the S&P 500 has gone up 6.57%.

When is a good or a bad time to buy any security?

We can only tell with hindsight.

But we immediately can see how good the percentage return on selling derivatives on any security is. Year-to-date, it has been exceptionally high on NVAX.

One of our members committed about $500,000 to NVAX shares to allow her to sell covered calls on it. Doing so, she earned about $18,000 that week!

But the stock price dropped and she lost about $170,000 on the NVAX stock! We wrote about that in our September 1 post.

Earning about 5% weekly on her investment, she is paring down her loss. The stock price is dropping — what is the outcome for her?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us