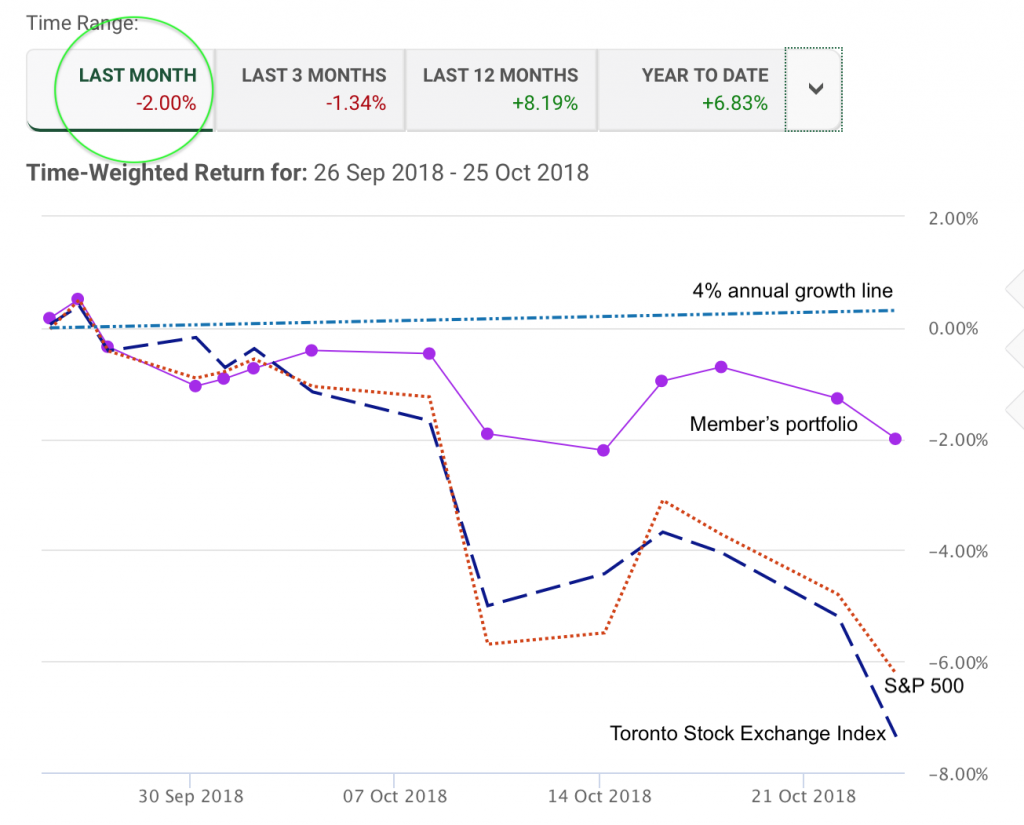

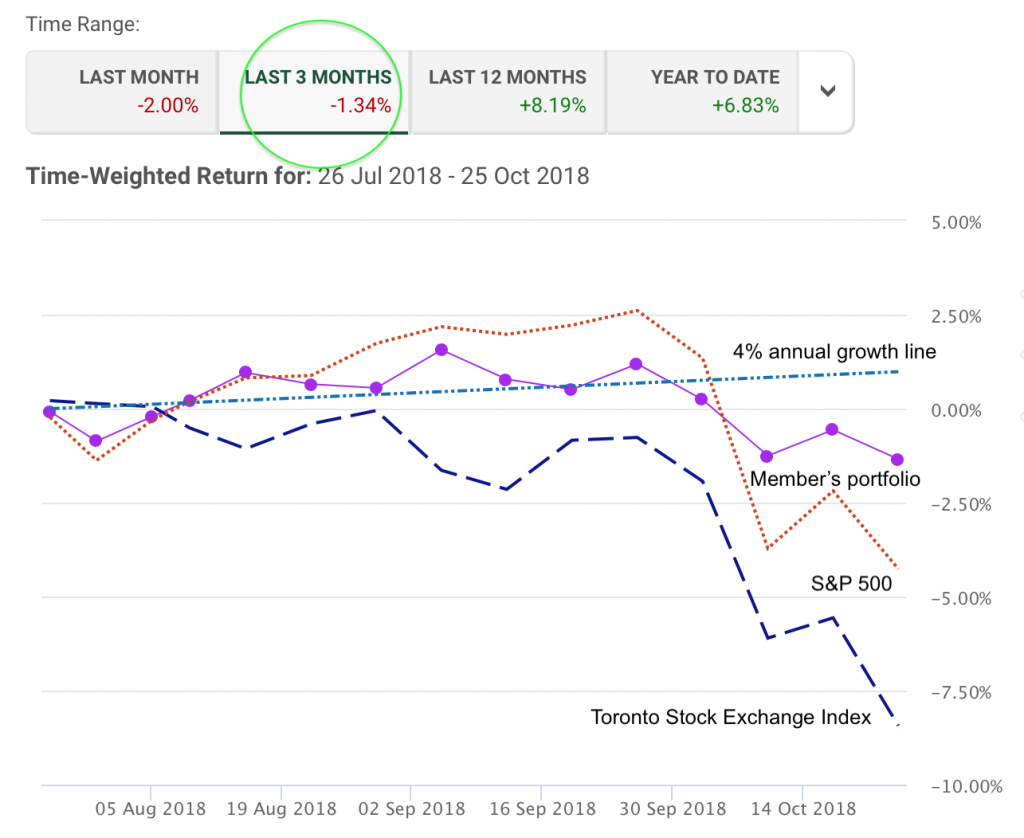

The charts below show one month and last three months’ performance of a Monday Morning Millionaire Program member’s core portfolio. (TD Direct Investing records) You can see that the portfolio has dropped about one third as much as the markets have dropped. This member maintains a 50/50 asset allocation, balancing an exchange-traded fund and cash.

and

Would you not expect such an asset allocation to result in a portfolio drop of half as much as the market instead of only a third as much? How does our member achieve this excellent result? Does he have a stratospheric IQ or unusual business insights or inside information?

None of these is needed to invest successfully. According to Warren Buffett, “what is needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding the framework.” Our upcoming new book titled Habits of Highly Successful Investors will describe such an intellectual framework in depth.

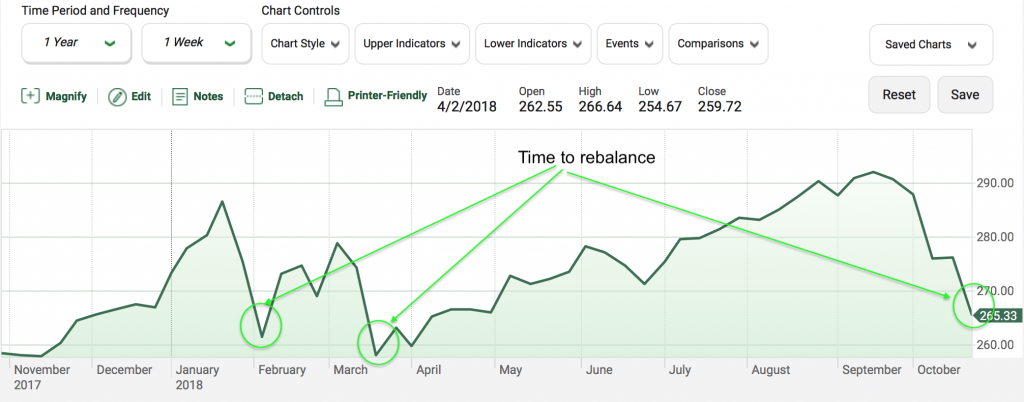

Without going into details, achieving the result shown above is straightforward. The investor simply re-balances the portfolio to maintain the chosen asset allocation every time the market moves about 10% in either direction. There were two such opportunities in 2018 and another one is shaping up at this time. Bargain buying time!

Additionally, this investor sold covered calls and cash-secured uncover puts when the premiums were unusually high.

The rebalancing needs to take place within the intellectual framework which Buffet talks about. Monday Morning Millionaire Program members know it very well.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us