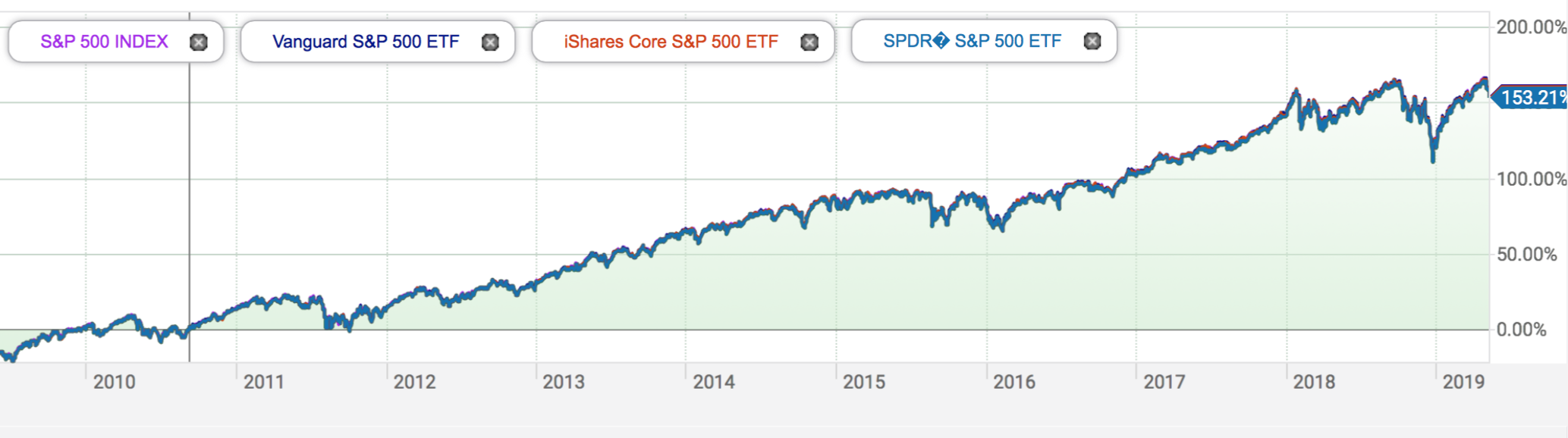

The market dropped precipitously in 2008. The FED (Federal Reserve System) cut interest rates to near 0% (see above) starting the longest bull market in history. The three exchange-traded funds (ETF’s) which you see below, mirror the S&P 500 index precisely. The four charts are on top of each other because they are identical.

Passive investing, as promoted by the Monday Morning Millionaire Program (15.5% annual return since 2012), does not need or use economic indicators. While proponents of both passive investing and active investing can produce studies to support their position, there is no question about their respective time requirements. 82% of Monday Morning members spend an average of one hour per week or less on their portfolios. By way of contrast, a few years ago, Goldman Sachs reduced (that says “reduced”) interns’ maximum working time to 17 hours per day!

However, many do enjoy active investing. We recommend that they expose a small part of their portfolios to active investing and call it their “fun” portfolios. My “fun” portfolio adds up to 5% of my holdings. It constantly validates passive investing. I have rarely made money in it.

Active investors use a large number of economic indicators to predict market movements and we will explore these in the coming weeks.

Today, we will look at Interest Rates and the Stock Market.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us