The title of this blog is borrowed from a book which Bill Gates wrote almost 20 years ago. We can apply it to the Monday Morning Millionaire Program way of investing, a variation of passive investing.

Malcolm Gladwell’s popular Outliers: The Story of Success is a study of the characteristics which contribute to high success levels. Gladwell frequently mentions the 10,000-hour rule which states that practising correctly for approximately 10,000 hours is a primary requirement for top-level expertise. On a personal level, all of us know that the longer we work at any skill, the better we become. Starting with grade one, we knew that longer, focused work produced better marks. We live with that experience-based view of the world, the earliest example of empiricism in our lives.

Enter the world of investing! Compare active investing results to passive investing results.

Active investors with large portfolios often spend 10 hours a day managing their investments. Passive investors with similar size portfolios often spend as little as 10 minutes a week managing theirs.

Active investors try to pick stocks and time markets attempting to outperform a benchmark such as the DJI or the S&P 500 or the MSCI or the Russell 3000.

- The DJI stands for the Dow Jones Industrials and consists of 30 large U.S. companies.

- The S&P 500 stands for the Standard and Poor’s and consists of 500 large U.S. companies.

- The MSCI Inc. stands for Morgan Stanley Capital International and consists of a broad cross-section of the developed markets in the world.

- The Russell 3000 Index consists of the 3,000 largest U.S. companies and represents 98% of the U.S. public equity market.

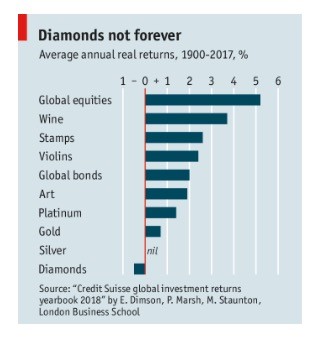

Passive investors select an exchange-traded fund representing one of the above market indexes, invest in it in line with their personal asset allocation strategy and go about their lives. They can spend less time managing their portfolios in a whole year than active investors spend in one day. How well has investing in global equities served investors over the last century? Look below.

Will investing in global equities continue to do well? Like so much in life, there are no guarantees but it looks like a safe bet.

Is your time valuable? Possibly, the results of actively managing one’s portfolio are worth the time spent. A search of the peer-reviewed academic literature supports both approaches. However…

About ten years ago, 20% of securities in the U.S. were passively invested. Today, more than 33% are invested that way. It has been predicted that passive investing will make up more than half U.S. retail investing activity by 2020.

What does that tell us? Can we do better? Monday Morning Millionaire Program members often do. Here is how.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us