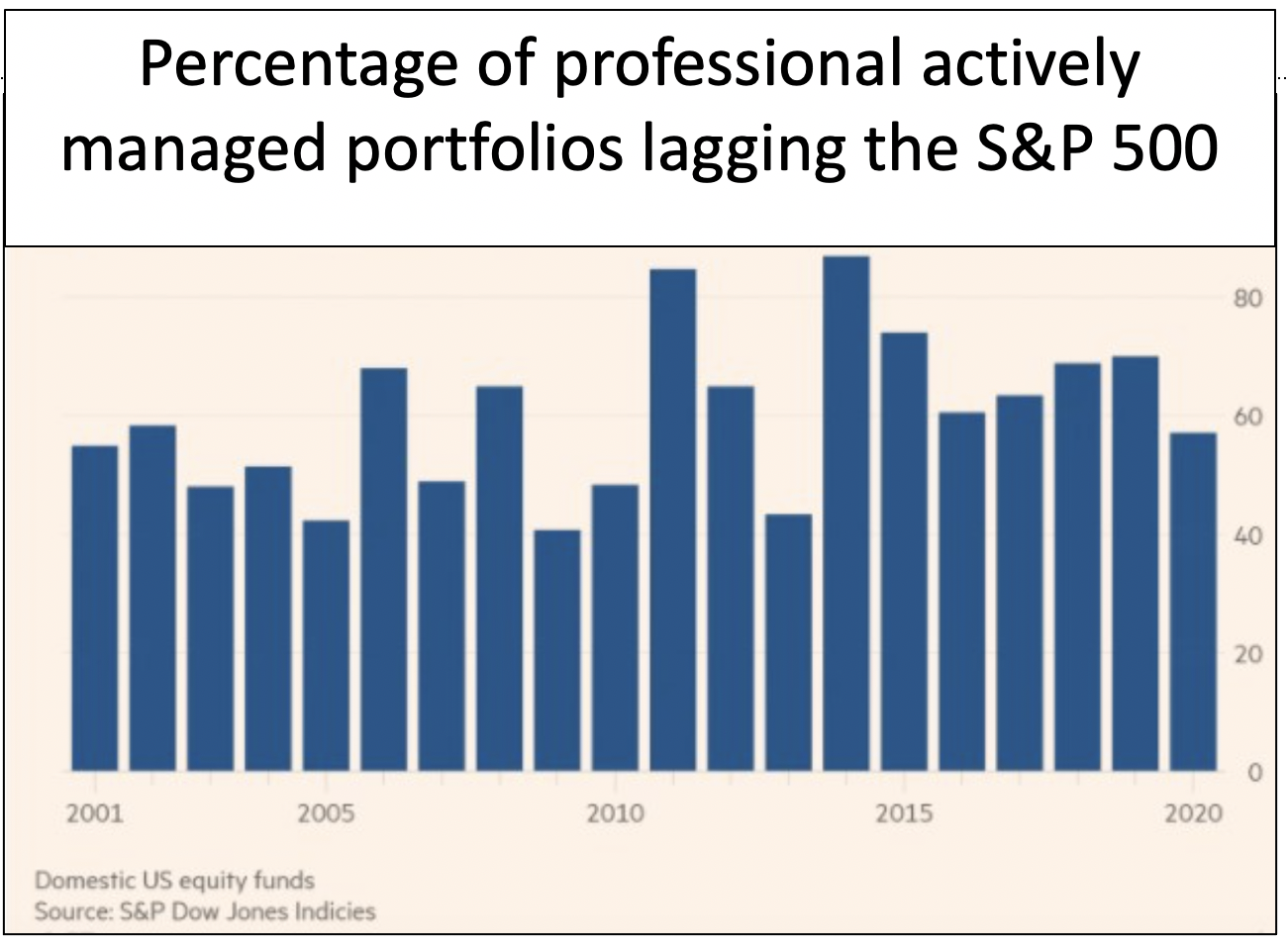

The above chart was recently published by S&P Dow Jones Indices. Not news to Monday Morning members, it supports the second of the six habits of Monday Morning Millionaires, namely, be a self-directed (do-it-yourself investor).

Certainly, money managers can equal the S&P 500. After all, we can teach a high school student how to do that. But they do need to buy groceries and pay the rent. Their clients pay for that so, understandably, matching the S&P 500 after their fees is exceedingly difficult to do consistently.

Warren Buffet’s mentor, Benjamin Graham, stated “To achieve satisfactory investment results is easier than most people realize.” Graham is considered by many to be the father of security analysis. His respected book, Security Analysis, co-authored with David Dodd, was published in 1934 and is still in print.

He made the above statement before the S&P 500 existed and before exchange-traded funds tracking it, were in place. With these tools now available, he would say, “To achieve satisfactory investment results is much easier than most people realize.”

Few people achieve satisfactory investment results. For the reason that this is so, go here and here and here.

Call (705-441-4566 ) or email me (milan@drmilan.com) if you want some assistance with being a do-it-yourself investor.

The Monday Morning Millionaire Program contains compressed investment opinions. Over the last two decades, these have outperformed over 90% of portfolios including professionally managed ones.

The program does not provide any investment advice or endorsements. With fewer than 400 words, members can read our posts in less than five minutes. Following and studying the links embedded in a post would take longer. How members manage a post depends on their level of interest and investing knowledge.