One of the habits of highly effective investors is to buy the entire US market at low-cost by acquiring exchange-traded funds (ETFs) which mirror the S&P 500.

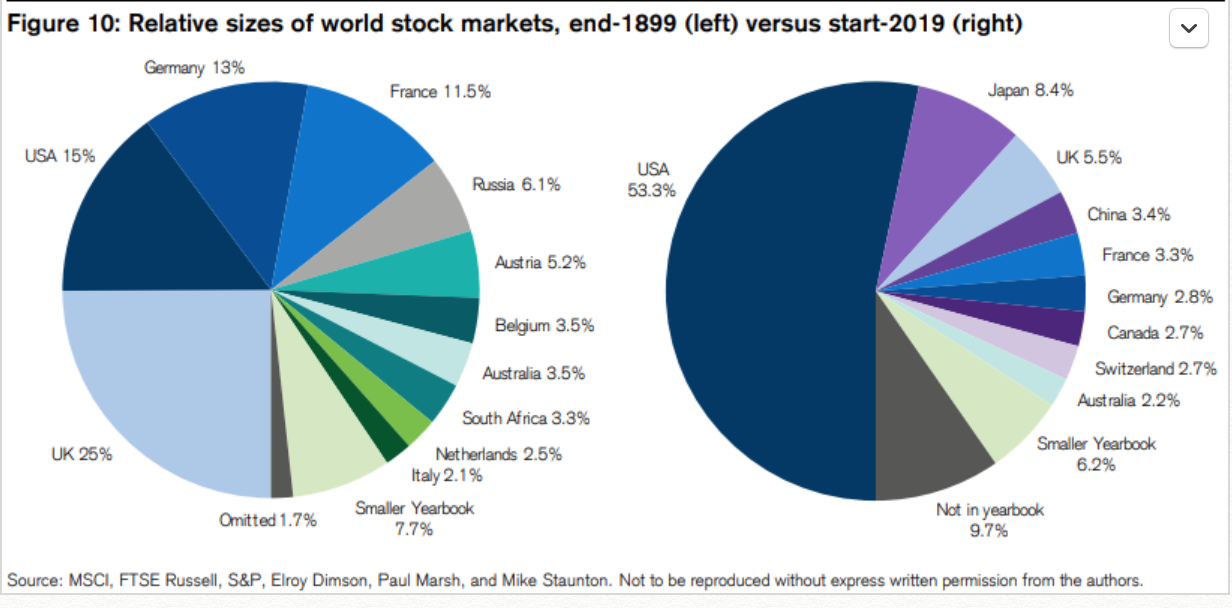

The chart above (used with permission from Prof. Dimson) shows why. Investors have made and lost money in every one of the markets you see above; it is easier to make more and lose less in a growing market. A little over 100 years ago, the US market accounted for 15% of the world stock market. Today, it has over a half!

The subject of exchange-traded funds is complex but until recently, the Monday Morning Millionaire Program stated that of the more than 5,000 ETFs, the six shown below are the ones that interest us.

The best ETFs to track the S&P 500 are:

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF (VOO)

- SPDR S&P 500 ETF Trust (SPY)

- Schwab U.S. Large-Cap ETF (SCHX)

- iShares S&P 500 Growth ETF (IVW)

- Guggenheim S&P 500 Equal Weight ETF (symbol RSP)

The first five are market-cap-weighted. The sixth one is equal-weighted.

In line with their asset allocation, Monday Morning Millionaire Program members keep form 30% to 70% in one of these with the balance in a money market fund.

The habit of buying the entire US market at low-cost by acquiring exchange-traded funds (ETFs) which mirror the S&P 500 is another way of saying don’t pick stocks. It is the third of six habits of highly effective investors. As Monday Morning Millionaire Program members know, these habits are: