Let us first review the habits of highly effective investors.

- Having an early, disciplined savings program

- Self-directed (do-it-yourself) investing

- Buying the entire US market

- Buying and holding

- Buying low, selling high

- Avoiding complexity

These can only be effective if practised on a background of a long-term view coupled with an asset allocation regime suitable for each investor.

What does “long-term” view mean? Money which you will need in less than five years does not belong in the market. And why not? Well, market fluctuation is fully predictable, however, the extent and the duration are not. You might need your money when the market is down. But, an upward trend over the long-run is also predictable allowing you to take out money when the market is up. Note the term “long-run”. Ten years is good, fifteen is better. This is the money you could be saving and investing for retirement or for buying a house or for your children’s or grandchildren’s education.

Concerning asset allocation, an internet search for the term produces over 28 million hits. You only need to read one – our January 15, 2018 blog titled “New Year’s Resolution. Yes or No?” Now, let us look at a specific example.

The 50/50 Asset Allocation

In keeping with the fifth and sixth habits of highly effective investors namely, buying low, selling high and avoiding complexity, with this approach, 50% of the portfolio is in a market index exchange-traded fund (ETF) and 50% is in a U.S. money market fund. Anytime that this relationship is thrown off balance by 5% to 10%, either by market growth or by market decline, investors can rebalance their portfolios and grow rich.

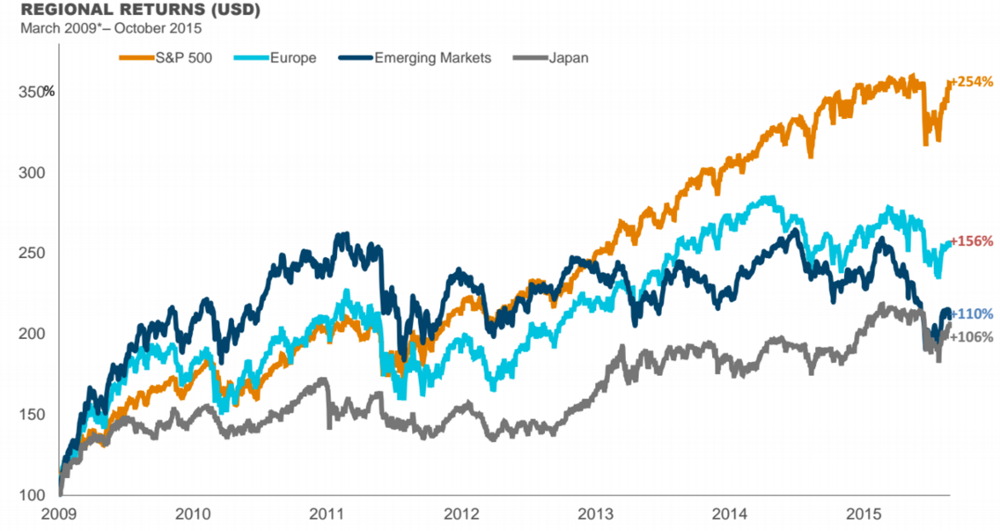

The market index ETF is a good representation of the entire U.S. economy, the most robust economy in history. Look at the 10-year record of several economies.

Japan’s economy rose 106%, emerging markets went up 110%, European markets grew by 156% and the American market soared 254%! The growth of the American market should silence those critics who say that holding the US market only in the equities part of the portfolio is insufficient diversification.

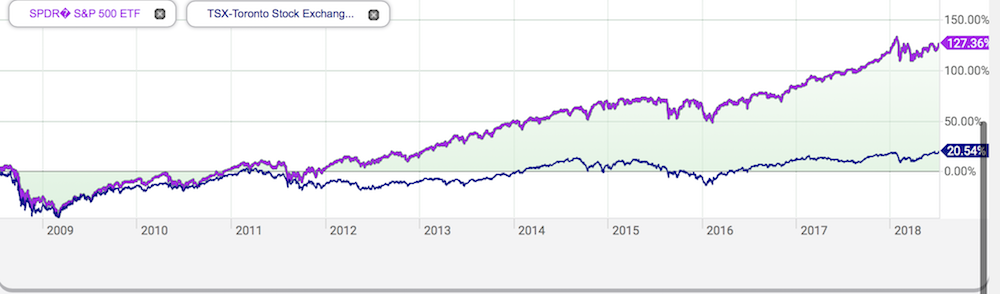

Our Canadian members and subscribers need to take a look at the chart below although, it is of interest to all investors.

During the decade ending in the middle of 2018, adjusted for the dollar exchange rate, the Canadian market went up 20.54%. During the same period, the US market grew by 127.36%! (The REGIONAL RETURNS chart above shows a different time frame.)

Empires do have a 100% failure rate and someday, the American empire will join the others. The end is not insight at this time. It is true that past performance is no guarantee of future performance, but it is the only information that we have and is an excellent guide much of the time.

The elimination of foreign content limits in registered portfolios in 2005? Thank you, Canadian government!

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us