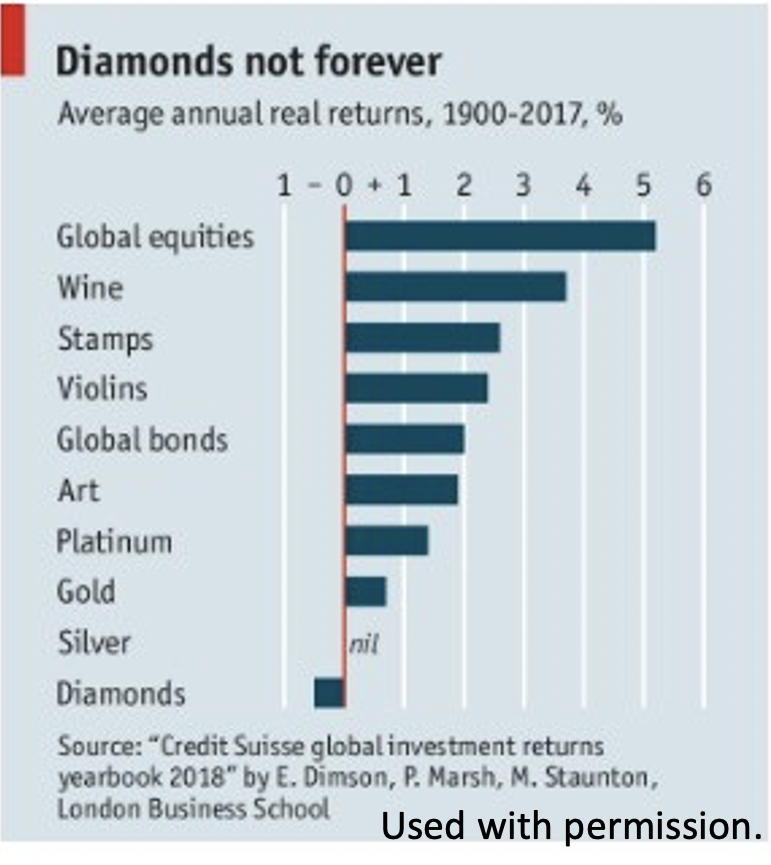

The chart above shows a list of common investments. Note that at the top of the list, global equities are the only example that actually generates wealth (most of the time). All the others depend on the greater fool theory. Buyers expect a greater fool to come along and take the investment off their hands at a higher price.

So yes, there have been individual cases in which an investment in one stamp or a violin or a work of art or a piece of property has outperformed global equities, i. e. the market, but that is cherry-picking.

Another example of cherry-picking is investing in bonds during a given period. During the 40 years from 1969 to 2009, government bonds outperformed the market. Only by 0.6% but still, outperformed. It is true that after taxation and inflation, bonds have negative returns most of the time.

During specific periods, gold was another example of cherry-picking. The annual return rate of gold since 1926 stands at 0%. Yet, from 2000 to 2009, while the stock market fell by 9%, gold went up by 180%!

For a fair comparison, we should cherry-pick the stock market. We only need to look at Facebook, Amazon, Apple, Netflix, Google and Tesla to observe incredible performance.

The title of this post is used for its dramatic affect. Some investors do beat the market consistently.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us