On April 16, 2019, from John G….. Ontario, Canada

Question:

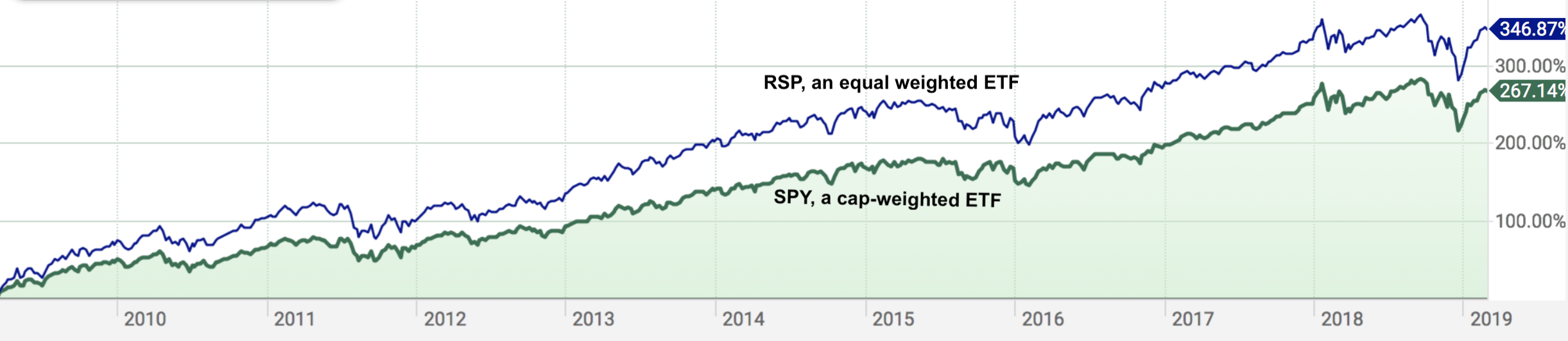

What was your motivation to switch from SPY to RSP? I understand the RSP exchange-traded fund (ETF) rebalances its exposure to less expensive stocks in the S&P 500 and trims stock that has become more expensive. But there is increased volatility and a higher MER.

Thanks.

Monday Morning Millionaire Program Answer:

The above chart shows that over the last decade, RSP, an equal-weighted ETF has outperformed SPY, a cap-weighted ETF. As you state, RSP, an equal-weighted ETF gives each of the 500 stocks an equal 0.02% of the fund and keeps it that way. In a capitalization-weighted ETF, the market price of each of the stocks influences the ETF. The stocks with a greater price have a disproportionate impact on the ETF.

Disregarding of the volatility and the MERs, RSP outperformed SPY. Using history to predict the future is unreliable but it is the best tool which we have. We made the switch based on history alone.

Since we made the switch one month ago, RSP has gone up 4.08%while SPY has gone up 3.65%. That 0.43% difference over the course of such a short time period is meaningless but it does suggest that the switch was a good decision. Both ETFs are a good way to buy the entire American economy and over the long run, both will likely give a good result. Both fit the Monday Morning Millionaire Program philosophy of practicing the habits of highly effective investors. Let us review them again.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us