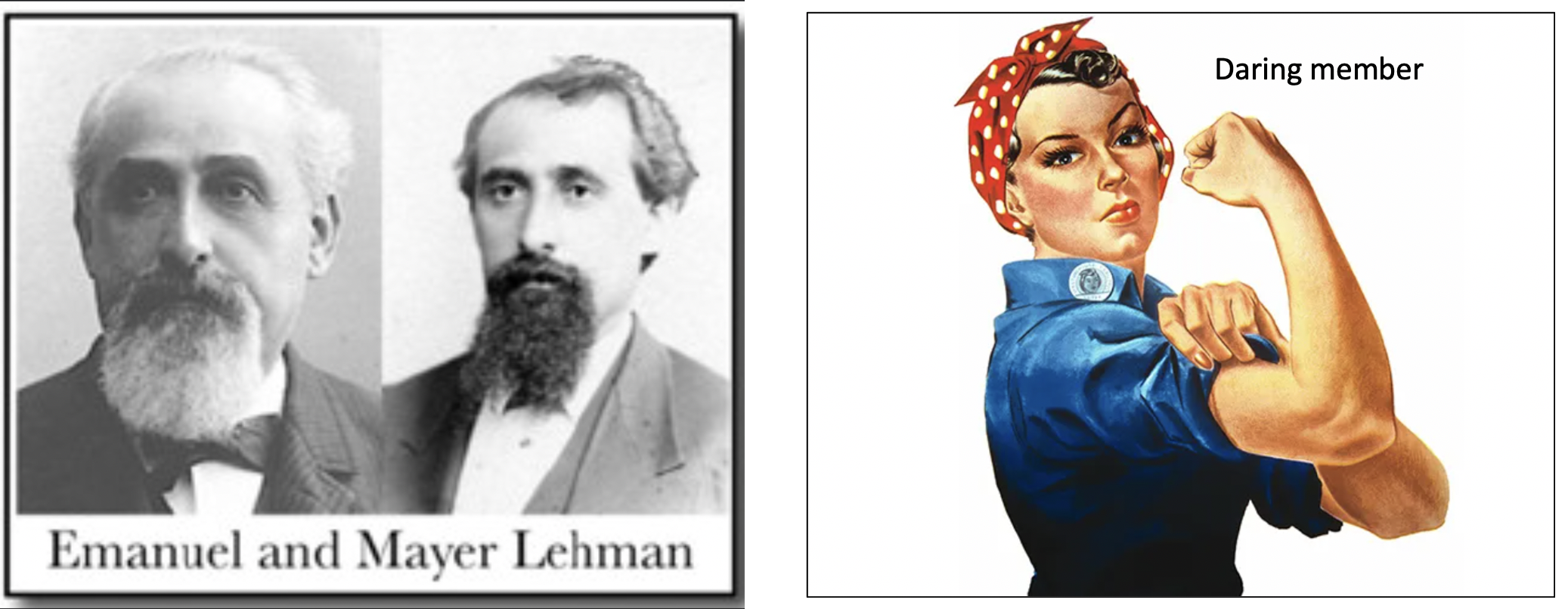

Exactly 12 years ago today, Lehman Brothers entered the largest bankruptcy protection filing in U.S. history. Why didn’t the Federal Reserve bail our Lehman like it bailed out AIG, Bear Stearns and other investment banks?

The Federal Reserve Chair Ben Bernanke stated: “A too-big-to-fail firm is one whose size, complexity, interconnectedness, and critical functions are such that, should the firm go unexpectedly into liquidation, the rest of the financial system and the economy would face severe adverse consequences.” Was Lehman not big enough? Many academic papers deal with this issue.

From the perspective of Monday Morning Program member, 12 years ago today was a great time to buy an exchange-traded fund tracking the S&P 500.

Time to remember.

On another note, our September 1 post told how, over several weeks, writing covered calls on Novavax (NVAX), an aggressive member lost just over $200,000 on $500,000 worth of the stock. However, her total premium income of about $118,000 brought her loss down to about $82,000.

Her portfolio growth, negative for now, continues to improve. How?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us