One of our members, a vastly experienced investor, recently told me that he starts his day by reading the Argus Market Digest. If you follow the link to this Digest, you will see that it is written by highly qualified experts, all 26 pages and 17,000 words!

I said, “Check your your life expectancy and calculate how many days you have left. Are you spending your time wisely?”

I told him that, by accident, I took out a year-long subscription to Seeking Alpha. I also read Ben Carlson daily and subscribe to 5iResearch. The last of these provides knowledgeable answers to investing questions about a specific company or something general.

Looking for “investment advice” produces nearly 5,000,000,000 hits on the Internet.

Before the Internet era, I once subscribed to every investment advisory newsletter available. Every one of them! My broker always made more money in commissions than I did in investments until I stopped doing that.

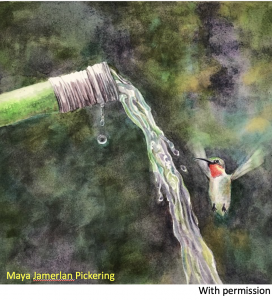

Drinking from a fire hydrant? A hummingbird drinking from a fire hose?

I can say with confidence that buying an exchange-traded fund that tracks the S&P 500 will outperform the vast majority of investors over a market cycle (peak to trough to peak). Investors who have a 50/50 asset allocation between the S&P 500 and a money market fund will get about the same results with half the fluctuations.

That is the concept which we promote in Monday Morning Millionaire.

One of our surveys shows that some of our members spend all day going over stock market issues. They do so because they enjoy it. That is a good enough reason. It will not improve their investment results.

Our member agreed that index investing has good results, especially when you weigh in the time spent. There are probably better ways to spend time than studying financial markets. Unfortunately, it can become addictive because investors are deceived into thinking that you know more than others.

Investment banks want us to trade and suck investors in with free research.

Trading is a loser’s game unless you are an investment bank. In that case, it is a winning strategy!

With is the habits of the Monday Morning program, luck hardly matters.

Good luck!