The title of this blog is the actual last sentence of an article published in a recent edition of the respected journal, The Economist.

The chart above shows the S&P 500 for September and October 2018 as well as three exchange-traded funds (ETF’S) which track it and which you see below. As expected, since all three ETF’s track the S&P 500, their charts are nearly identical.

| S&P 500 Index – ETF Tracker | |

| ETF Name | Symbol |

| SPDR S&P 500 ETF | SPY |

| iShares Core S&P 500 ETF | IVV |

| Vanguard S&P 500 ETF | VOO |

They are trending down! Moreover, a trend is more likely to continue than to reverse itself.

So, how can we start preparing now for the next recession?

See

How Monday Morning Millionaire Program members prepare for a recession

below.

Market Insights

We will publish these occasionally, from now on. They will be based on the previous week’s noteworthy observations by various pundits. For Monday Morning Millionaire Program members, the Market Insights primary value will be to contribute to cocktail party conversations. For over a decade now, members’ portfolios have outperformed over 90% of all portfolios including those managed by professionals. For members, pundits’ market insights have no practical value, but their entertainment value can be significant.

The insight of the week

Without exception, every mid-term election since World War II has been good for the stock market. Every one of them!

In non-voting years, the S&P 500 index rose a median of 4.9% for the nine months following the mid-terms. The S&P 500 index rose a median of more than three times as much! It works out to 18.4%!

Active investors can spend hours daily using that information to pick stocks in time markets. They will be correct half the time since current prices reflect all that is known about securities and markets and since each transaction has two sides to it (one buyer, one seller) only one of which can be right. As in the past, Monday Morning Millionaire Program members all of whom are passive investors, will outperform over 90% of active investors and work on their portfolios about 15 minutes per week.

How Monday Morning Millionaire Program members prepare for a recession

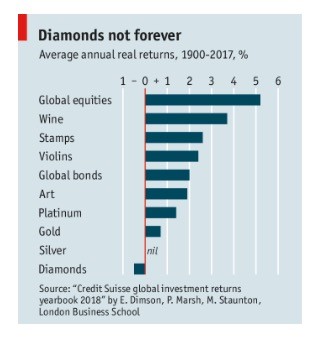

Why invest in the market? First, the returns are generally better than possible with other investments. (See the chart below, used with permission.)

In addition, constantly quoted prices, low transaction costs, accurate records and absolute liquidity make stock market investing attractive.

Over the last 20 years, investors following the Monday Morning Millionaire Program investing style have equaled the average S&P 500 return of 7.68%. The average equity fund investor earned an annual gain of 4.79% during that period.

How do Monday Morning Millionaire Program members get these results?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us