Albert Einstein said that compound interest is the eighth wonder of the world. Some writers have stated that he discovered the rule of 72 and that he considered it more important than discovering E = mc2! That could be an exaggeration, nevertheless….

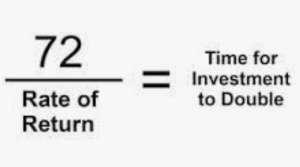

A brief review of the rule of 72:

If we take the rate of return and divide it into 72 we can easily calculate how long it takes for a portfolio to double its value without adding additional cash.

Over the last 200 years, the US stock market has returned 10% annually, not inflation-adjusted. That means that a portfolio invested in the US stock market, as represented by the S&P 500 and its former equivalent would double every 72 divided by 10 = 7.2 years. (The S&P 500 was launched in 1957.)

We can use the same formula to calculate the rate at which money loses half its purchasing power during an inflationary period.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us