Monday Morning Millionaire Program members put their savings into equities because of good returns, constantly quoted prices, low transaction costs, absolute liquidity and the excellent record keeping provided by brokers.

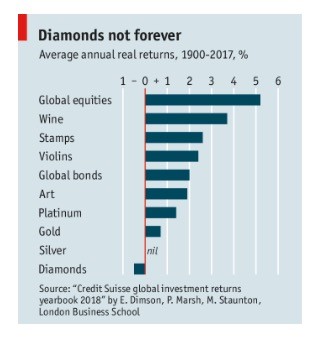

Since 1900, equities have provided investors with an inflation-adjusted return of 5.2%. It is the best-performing asset class. There are no guarantees in this performance will continue but the absolute liquidity is as certain as can be in this uncertain life. That would allow investors easily to shift assets to better performing classes if they are able to find them.

Follow https://www.frbsf.org/economic-research/files/wp2017-25.pdf to read the academic paper on which this blog is based. The paper uses an enormous data set which, for the first time, includes housing.

Unlike Monday Morning Millionaire members, most investors do not equal the market’s returns. How do Monday Morning Members do it?

* Jordà, Òscar, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, Alan M. Taylor. 2017. “The Rate of Return on Everything, 1870–2015” Federal Reserve Bank of San Francisco Working Paper 2017-25. https://doi.org/10.24148/wp2017-25

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us