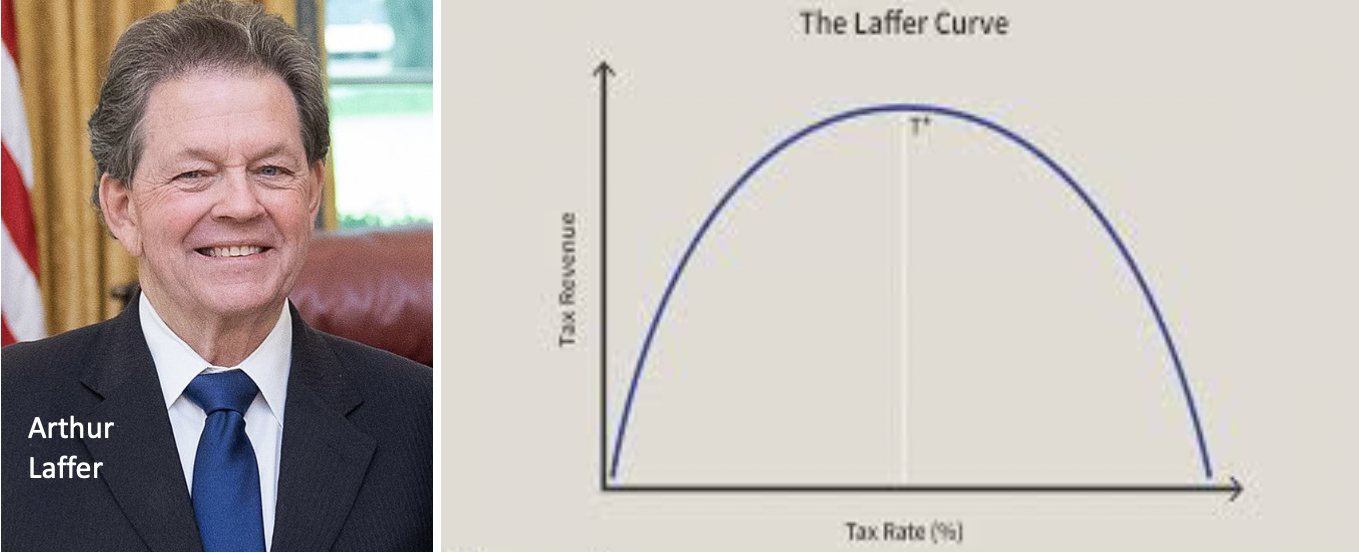

The Laffer Curve states that up to a certain point, tax revenue rises as tax rates increase. Increasing tax rates past that point results in taxpayers working less or not at all, an increase in tax avoidance and tax evasion and a decrease in tax revenue. Zero percent tax rate equals zero tax revenue; 100% tax rate also equals zero tax revenue.

Economist Arthur Laffer allegedly drew his famous curve on a napkin during a 1972 meeting with Ford administration policymakers. Economists debate the details of the Laffer Curve, but all agree that it exists.

Well, governments have figured out how to impose a 100% tax rate and still get meaningful tax revenue, Laffer Curve be damned.

In one word – inflation.

And governments control inflation to a significant extent.

If the rate of inflation is equal to or greater than the return on an investment, it is the same as having an income tax rate of 100% (or more) on the returns on that investment.

For more than half of the years of the last decade, the inflation rate was greater than the interest paid on cash deposits at the bank, certificates of deposit, money markets, many AAA bonds and other investments considered to be safe. Inflation resulted in a 100% income tax rate on what these investments earned.

Only it did not seem so.

After all, investors got all their money back. However, at any one time, that money bought less than what it bought yesterday and even less than what it will buy tomorrow. A 100% income tax rate!

Before retiring, my next-door neighbour used to create PhD’s in economics for a living. An emeritus professor in economics from one of our major universities, about eight months ago he stated that he could not understand why we had no inflation.

And today? If you have been to the grocery store recently or bought some gasoline or lumber or clothing or propane or god forbid canola oil, you can see that inflation is solidly in place. The returns that your “safe” deposits generate are being taxed at 100% or more.

However, note (again) Gerald Loeb‘s thoughts on successful investing. “It is far better to let cash lie idle than to buy just to “keep invested” or for “income.” In fact, it is really vital—and just this one point, in my opinion, represents one of the widest differences between the successful professional and the loss-taking amateur.”

If the returns that the cash or near-cash earns are taxed at 100% or more most of the time, how much cash or or near-cash should investors keep in their portfolios?

The late John Bogle, who popularized the concept of asset allocation personally kept 50% in US market index exchange-traded funds and 50% in cash or near-cash.

As David Swensen taught us, “…asset allocation accounts for the largest share of portfolio returns.” and “…security selection and market timing make no material contribution to returns…”

Effective investors accept the cash drag resulting from keeping cash or near-cash in their portfolios to have it available to buy the bargains when inevitable market corrections occur.

With the habits of the Monday Morning program, luck hardly matters.

Good luck!

_______________________________________________________

We have designed the Monday Morning Millionaire Program to offer abstracted investment education. Over the last two decades, the program has outperformed over 90% of portfolios, including professionally managed ones.

The program does not provide any investment advice or endorsements.

Members can read our posts in less than five minutes. Following and studying the links embedded in these posts would take longer. How members manage a post depends on their level of interest and investing knowledge.

The Monday Morning Millionaire Program contains compressed investment opinions. Over the last two decades, these have outperformed over 90% of portfolios including professionally managed ones. The program does not provide any investment advice or endorsements. With fewer than 400 words, members can read our posts in less than five minutes. Following and studying the links imbedded in a post would take longer. How members manage a post depends on their level of interest and investing knowledge.