Retiring at or near a market peak could be devastating to your financial well-being.

Rising markets result in rising portfolio values – most investors love it. Experienced investor and investors with a Monday Morning Millionaire Program mindset know that market peaks are followed by market declines. Reversion to the mean is one of the inescapable characteristics of stock market investing. So, why invest in the stock market?

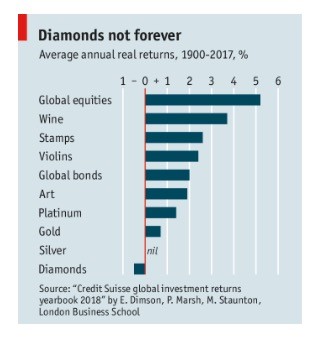

We often draw attention to the chart below (used with permission) showing investing in global equities has been the best place to put savings for over 100 years.

We have frequently stated that, based on the last decade, a U.S. market index Exchange-Traded Fund (ETF) which tracks the S&P 500, held in a tax-advantaged account, has been the investor’s most reliable way of growing savings and is likely to remain so for many years.

Why is that?

With all its flaws, the S&P 500 is an accurate reflection of the health of the American economy. Since the second world war, the American economy has been the strongest economy in history (as measured by GDP). It remains so. The British economy held that position up to the second world war. Money should go where it is treated best which, today, means it should go into the American economy. Economies fluctuate and markets fluctuate with them. From the bottom of the 2009 market recession and leading up to 2018, we have seen the longest period of economic growth. We don’t know when that will come to an end and when the inevitable decline will begin, but we know that it is inevitable. Our portfolios will begin to decline and so will the income which we derive from them.

However, here is a corollary. For those who ran their own business, an important outcome of the strength of the economy is that they got out of business and into retirement by selling for a figure which could not have been obtained in a weak economy. They sold at the top.

For those retiring after a career of working for someone else, a strong economy provided an excellent income with a good benefits package which would be unavailable in a week economy.

But, retiring at or near a market peak could be devastating to one’s financial well-being? Really? Is it possible to protect against that?

Yes, it is. There are three important ways.

First, investors need to have the right attitude. It helps to realize that they have a first-world problem here. Placed in context, investors need to be aware of the fact that in much of the world, 25,000 children will die today from various causes. That is as many as died yesterday and will die tomorrow.

The second way — this one practical and not philosophical, is to have a sensible asset allocation. A 50/50 asset allocation between an index-exchange traded fund which tracks the S&P 500 and cash, performs (nearly) just as well as being fully invested in the S&P 500 but with half the fluctuations, that is, half the risk. During market declines, a portfolio with this asset allocation only incurs half the losses of a fully invested portfolio. Over the course of a market cycle, this portfolio equals one which is fully invested in an ETF that tracks the S&P 500.

As we stated in our October 22 blog, 5% to 9.9% drops (pullbacks) happen more than twice a year, 10% to 19.9% drops (corrections) twice within three years and 20% or more drops (bear markets), once every five years. Recovery period ranges between two months and 14 months. There are not, or there should not be any members of the Monday Morning Millionaire Program who could not live on 20% below their usual income, for 14 months at most.

The third way is the most effective and offers full protection against portfolio losses during market drops.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us