I will occasionally publish with comments, our core portfolio and our “fun” portfolio holdings and the activity which took place on Monday. Following holiday Mondays, we will publish this information on Tuesdays.

We’ll start today’s report with our fun portfolio because it is so instructive. It is a corporate, margin account that allows us to trade puts and calls. It represents about 5% of the overall value of our portfolios. No matter what this portfolio does, it will have a small overall effect. Maintaining a “fun” portfolio could, however, uncover exceptional opportunities that could then be applied to a core portfolio and thereby have a meaningful effect.

Let us take a look.

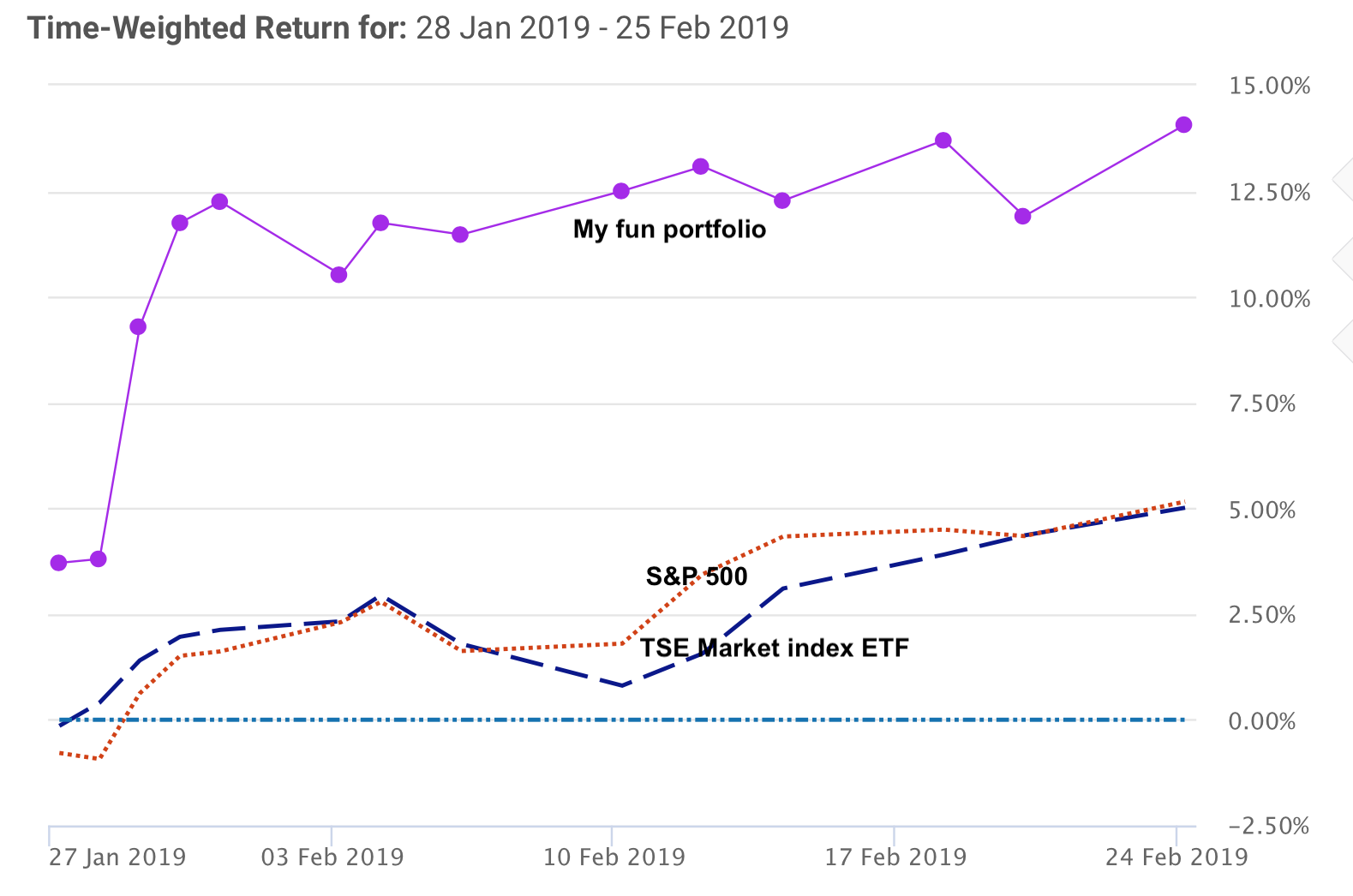

Impressive, right?

For the four week period from January 28 to February 25, the portfolio is up 14% while both the S&P 500 and Toronto Stock Exchange Market Index are up only 5%. But for the year the overall portfolio is down 33.22%! Not so impressive, is it?

Why is the portfolio down?

I bought AbbVie Inc. (symbol ABBV) at $US122.00 in January 2018 because the derivatives on this stock paid a very high premium. It trades at about $US79.00 these days. The only way to beat the market is to break one or more of the habits of highly effective investors. It is also the only way to get hurt over the course of a market cycle. So far, so bad!

Could we make up the losses in the future?

Possibly. Big pharma (such as ABBV) generally is behaving in morally reprehensible ways. The beat-up price could stay beat up for a long time.

The CORE PORTFOLIO (tax-advantaged) remains unchanged.

Following Paul Samuelson’s advice that investing should be more like watching paint dry or watching grass grow yesterday, Monday, 03/04/2019, as usual, I did nothing.

47.70% (about five years’ worth of my usual annual income) of this portfolio is in a US Money Market Fund (TDB166). The rest of the portfolio is in an exchange-traded fund which parallels the S&P 500 (SPY) which itself is an excellent proxy for the entire US economy.

My asset allocation (50% money market/50% exchange-traded fund which mirrors the S&P 500) outperforms a dropping market. In a rising market, it underperforms. Over the course of a full market cycle (peak to trough to peak) it equals the S&P 500 with half the volatility, that is, half the risk. The MarketWatch article ‘Nifty 50/50′ portfolio keeps investing simple is well worth studying.

CORE PORTFOLIO PERFORMANCE

Because we took advantage of the four buying opportunities in 2018 (a market drop of 10% or more), our core portfolio is up 1% over the last 12 months. The market is down 4% and because of my age, we were required by law to withdraw 4.5% from this tax-advantaged portfolio. In other words, we outperformed the market by 9.5%.

My wife Rosi’s core portfolio is similar to mine.

Back to the fun portfolio. Why is it doing so badly? What rules did we break here in our failed attempt to beat the market?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us