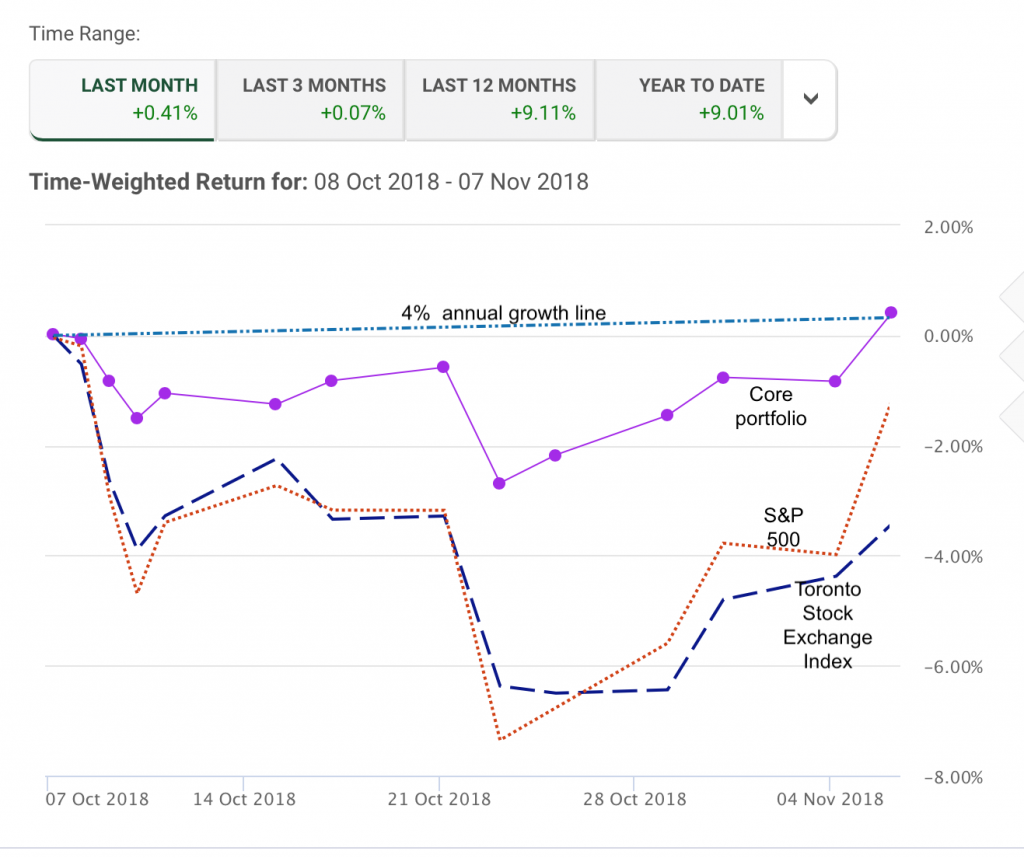

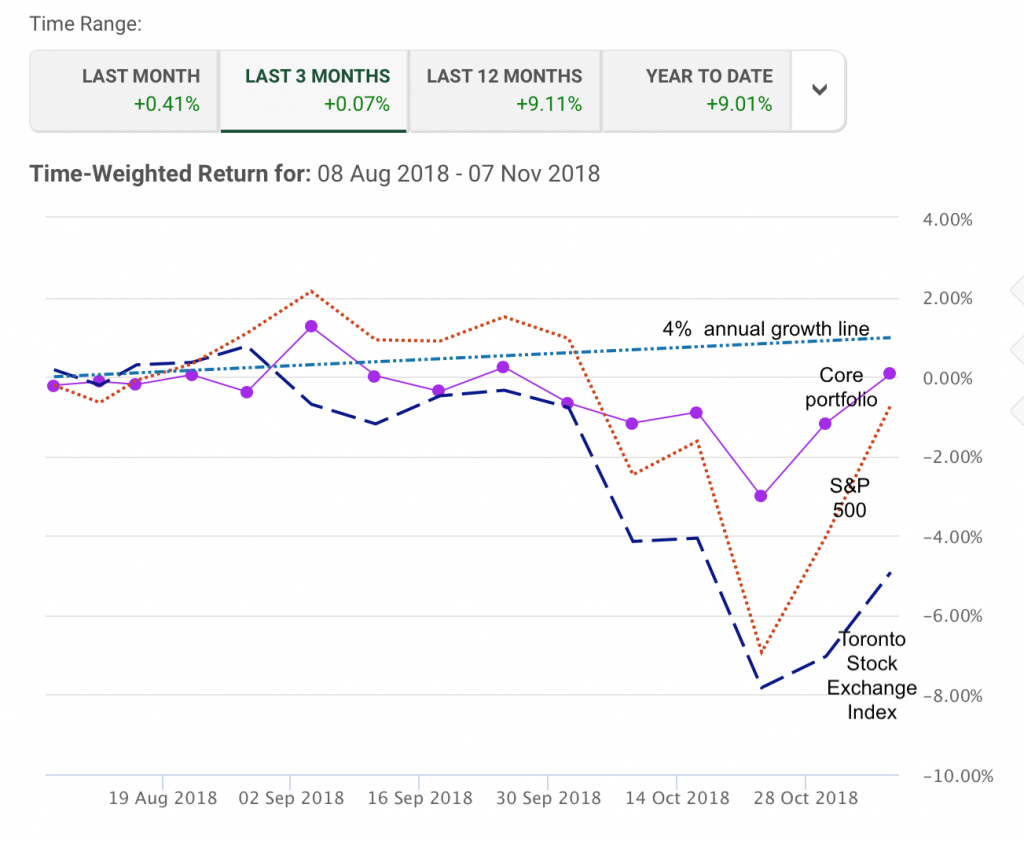

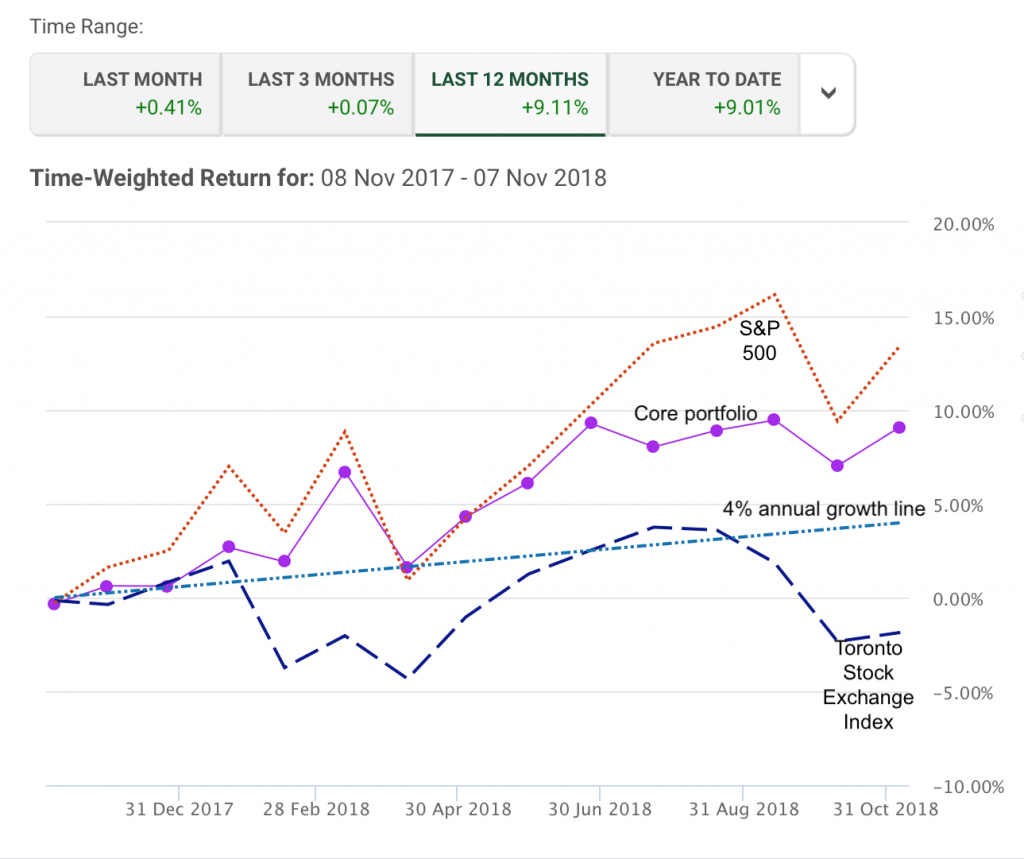

We report here or on our actual core portfolio performance. All charts are as shown by TD WebBroker where we maintain our portfolio.

The one-month chart above shows that our core portfolio gained 0.41% annualized while the S&P 500 lost about 1% and the Toronto Stock exchange lost about 3 1/2%. We can expect our core portfolio to outperform a dropping market since the portfolio asset allocation is 50/50 in a market index exchange-traded fund (ETF) and cash. The ETF half loses value, the cash does not.

The three-month chart above tells a similar story. The ETF half loses value, the cash does not.

The 12-month chart above shows the effect of cash drag in a rising market with our asset allocation regime. The ETF half gains value, the cash does not.

Over the course of a decade, observing the habits of highly effective investors, we can expect to equal US market growth with half the volatility, that is, half the risk. Sleep comes easier.

How do Monday Morning Millionaire Program members get these results and do so reliably? How is our “fun” portfolio doing?

Our upcoming booklet, Habits of Highly Effective Investors, goes into the technique in detail. Early in 2019, the booklet will be available at no charge to our members.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us