Our fearless, intrepid investor lost $65,700 in 2021, writing (selling) covered calls on Novavax (NVAX) in her “fun” portfolio. Attempting to outperform the market, “fun” portfolios ignore one or more of the six habits promoted by the Monday Morning Program. Most of the time, they are not much fun; they underperform the market.

Last Friday, February 18, NVAX closed at $81.89. Morningstar now states that NVAX is undervalued at a 50% discount so she will hold the stock and not write covered calls on it but wait for the market to realize that this security is undervalued.

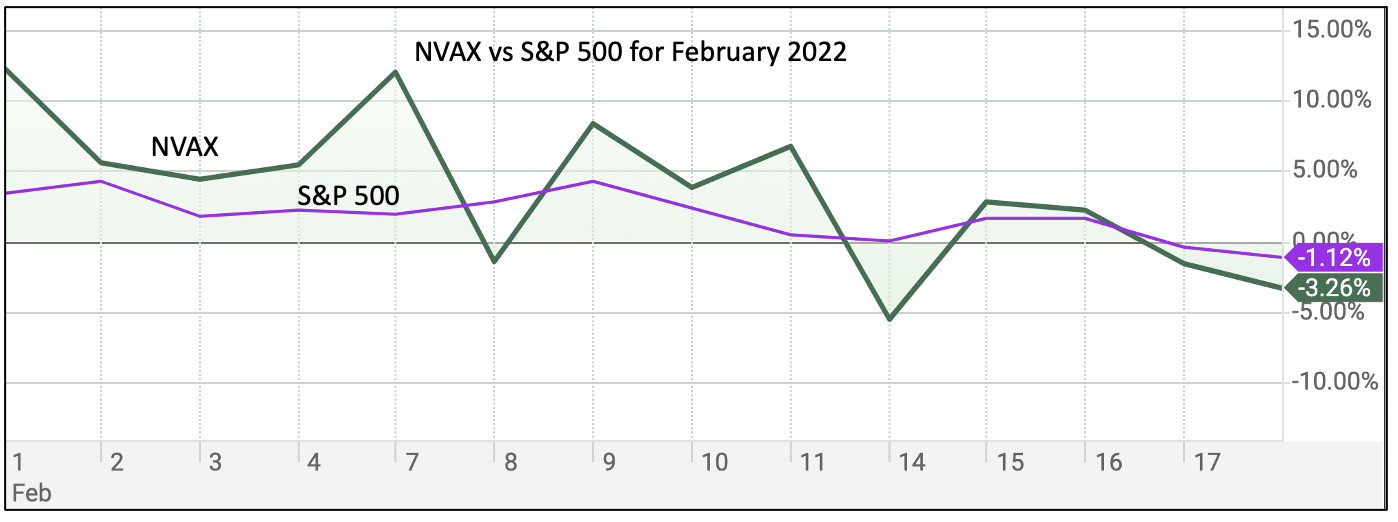

In February to date, NVAX dropped 3.26% while the S&P 500 dropped 1.12%!

That vindicates the validity of habit number 3, which is to buy the US economy as a whole and not to pick individual stocks. (Investors can do that by buying an exchange-traded fund which tracks the S&P 500. SPY is an excellent example.)

What does she plan to do with NVAX when the market opens at 9:30 AM today? (Canadian markets are closed today for Family Day. US markets are open.) Does she plan any further derivatives selling?

She expects NVAX price to keep rising, so, in order not to be assigned, she plans to continue holding the stock and waiting for it to rise in price before she starts writing covered calls on it again, if at all. This is an example of market timing which is not a good idea. Done in a “fun” portfolio, it’s acceptable.

She has opened a margin account that allows her to sell cash-covered puts. (Only sell and never buy puts and calls.) Selling cash-covered puts has precisely the same risk factors as selling covered calls; nevertheless, it is not permitted in Canadian tax-advantaged portfolios, although it is allowed in American ones.

She planned to move all her cash, money market funds and securities from her tax-free savings account (TFSA) into this margin account. She can do that without incurring taxes.

Further, in this margin account, she planned to write cash-secured puts on Bank of America (symbol BAC). Now, realizing that picking an individual stock would ignore habit number 3, she is reconsidering.

Most “fun” portfolios are not much fun. Picking individual stocks is the wrong thing to do half the time. Either the buyer or the seller is right. Both cannot be right.

Who would drive a car knowing that there is a 50% chance of an accident? Picking an individual stock will be the wrong decision for half the investors.

On Monday, February 28, we will report how her tactic worked out and her plans for that week.

Remember what you see below.

Resulting from its involvement in derivatives, in 1994, California’s Orange County declared bankruptcy.

Resulting from its involvement in derivatives, in 1998, Long Term Capital Management needed a $3.6 billion bailout from 14 financial institutions to prevent market panic and collapse of the entire financial system.

Gambling with derivatives, many individual investors keep losing 100% of their money.

___________________________________________________

We have designed the Monday Morning Millionaire Program to offer abstracted investment education. Over the last two decades, the program has outperformed over 90% of portfolios, including professionally managed ones.

The program does not provide any investment advice or endorsements.

Members can read our posts in less than five minutes. Following and studying the links embedded in these posts would take longer. How members manage a post depends on their level of interest and investing knowledge.