Long-term thinking is important. Such a mindset takes the sting out of inevitable market drawdowns and produces excellent, evidence-based results.

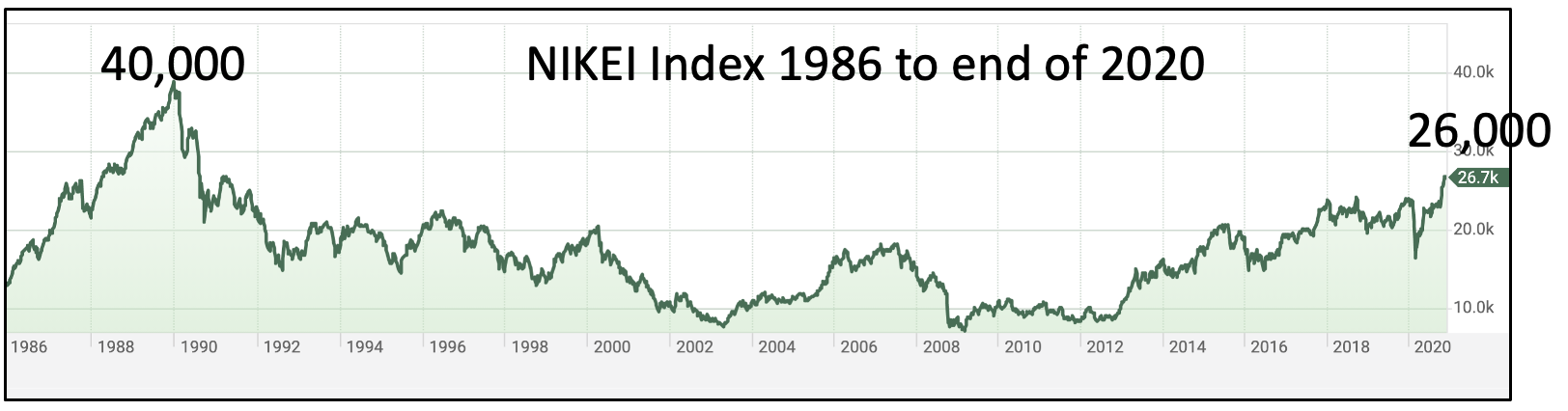

But how do we account for the Japan experience? It is now in its third lost decade, with the Nikkei index at little more than a half of what it was in 1989! How long is the long-term?

Would Japanese investors buy into the concept of long-term thinking?

We are looking at a speculative bubble here, much like the well-known tulip bubble of 18th century Holland or the less-known narwhal tusk bubble of about the same time.

Thanks to the alleged curative and aphrodisiac properties of ground-up narwhal tusk powder, the tusks were priced at three times their weight in gold. The Japanese stock market in 1989 was much closer to a bubble than to a normally operating stock market.

The Japanese stock market in 1989 was much closer to a bubble than to a normally operating stock market.