This past Monday, April 12, we described our covered call positions on SPDR S&P 500 ETF Trust (SPY) and Novavax (NVAX).

The Monday Morning program does not recommend that members get involved with options (puts and calls) unless they’re comfortable with the idea. Members can do very well only practising the six habits which we promote.

Invest to the sleeping point.

If you are selling options (only sell and never buy options) consider mainly writing covered calls. With the right timing, you can collect the dividends which the underlying company pays. That is not possible with cash-secured puts.

The risk in writing (selling) covered calls is identical to writing cash-covered puts, and it mainly arises from the underlying security.

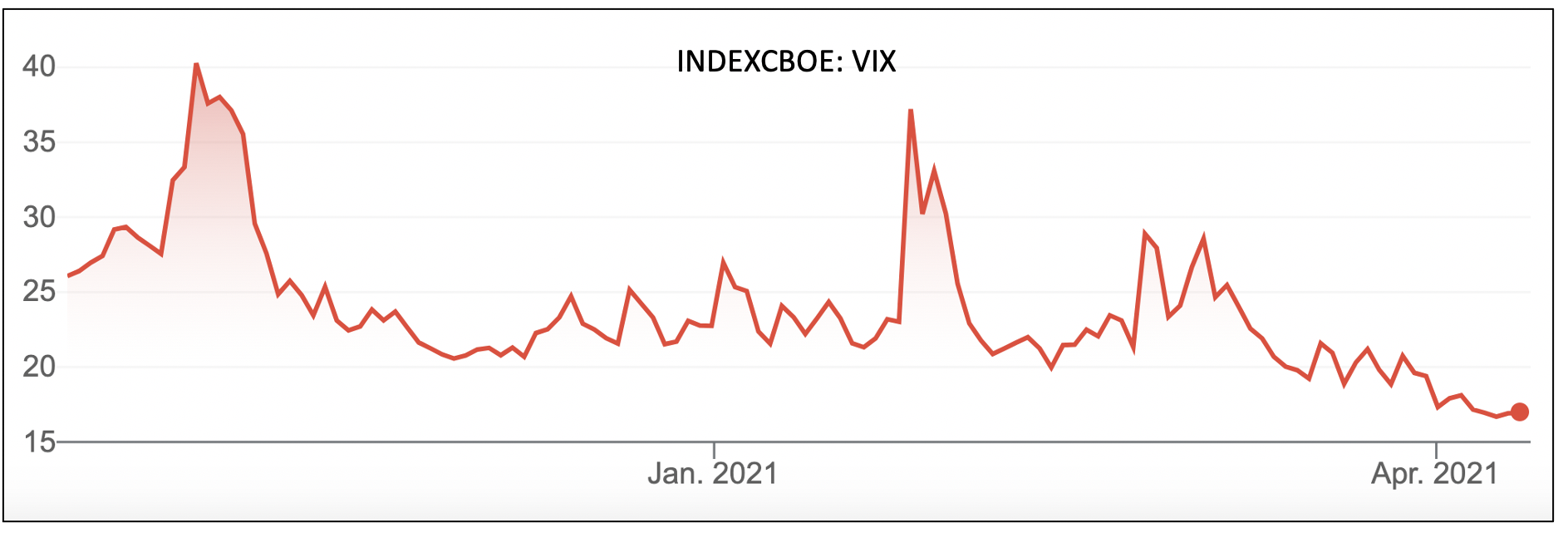

The premiums which investors can receive writing covered calls depend on a number of factors.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us