The Berkshire Hathaway (BRK) annual shareholder letter is now available. As usual, there is a great deal of wisdom in it. You would enjoy it it regardless of whether or not you are a BRK shareholder.

For more than 15 years, I owned nothing but BRK-B. It was a no-brainer, effortless way to get outstanding investment results. About three years ago, I became interested in writing (selling) covered calls and cash-secured puts. (Only sell and never buy options.) BRK-B was not the best choice for that because it only has monthly expiry dates. SPY, which mirrors the S&P 500, has three weekly expiry dates, so I sold all my BRK-B shares and bought SPY.

I did the right thing for the wrong reasons.

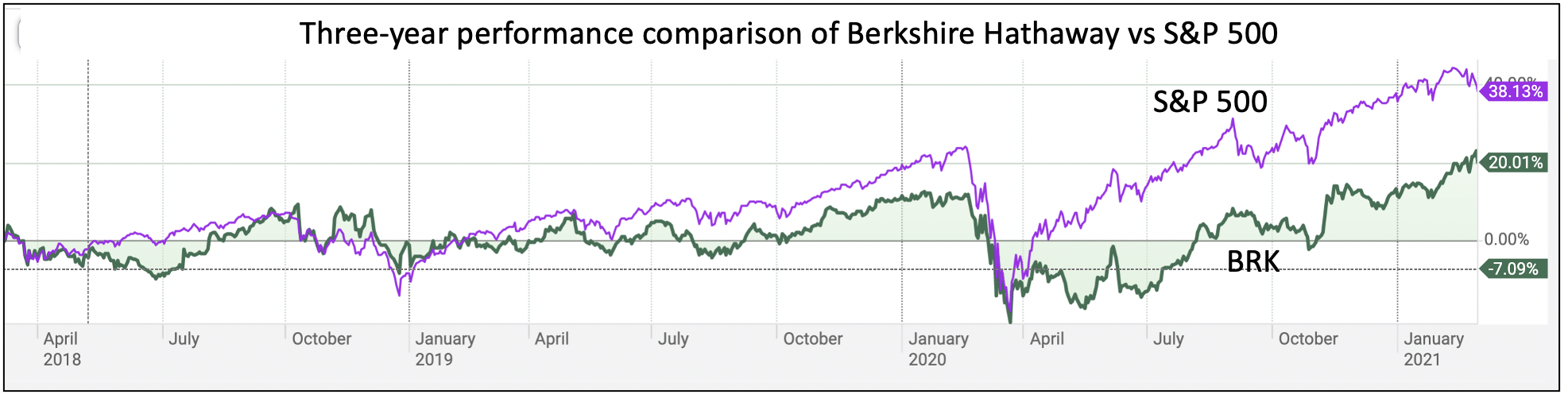

As the chart above shows, SPY has outperformed BRK over the last three years. Buffett and Munger predicted that outcome a long time ago. BRK is so large that it cannot turn on a dime the way it used to be able to, when it was smaller.

Buffett himself invests a large part of his portfolios in an index exchange-traded fund.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us