In 1912, when asked what the market will do, the renowned financier JP Morgan stated: “It will fluctuate.”

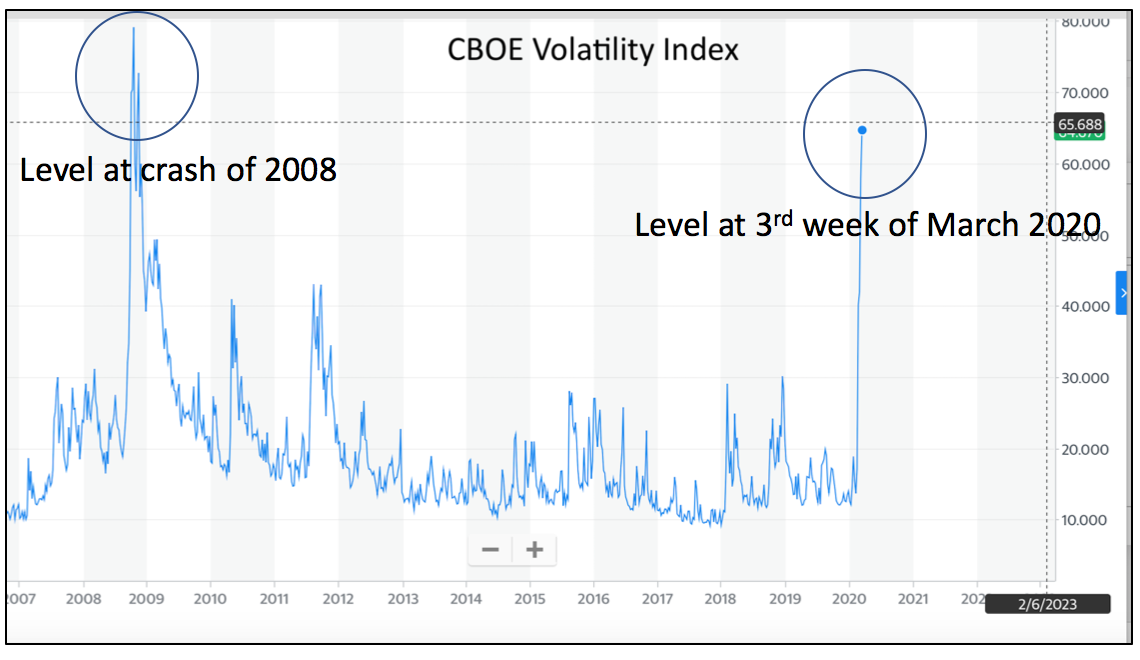

In 1992, the Chicago Board Options Exchange created the VIX index to track the extent of the fluctuations.

Risk is defined as the extent of volatility but Monday Morning Millionaire Program members know how to generate impressive returns in this environment.

One of our members who recently started to use options generated a safe 1% return on an investment in one day. Another member, more experienced, is generating between $US45,000 to $US50,000 each week on a $2,000,000 portfolio. (About 4% per week)

Do the math, scale this up or down to apply to your portfolio and see what it can generate at 4% per week using this method.

How do Monday Morning Millionaire Program members do it?

The VIX is called the fear index. When it is high and markets panic, Monday Morning Millionaire Program members use derivatives to generate extraordinary returns. Options premiums are influenced by a number of factors, volatility being an important one. A high VIX produces high premiums.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us