Which would you prefer — a lower interest rate on your debt or a higher interest rate on your savings account? Can you have both?

The average recent dental school graduate has a debt of $292,159.00 today, according to the American Dental Education Association estimates. For veterinarians and optometrists, the debt burden is in the same league.

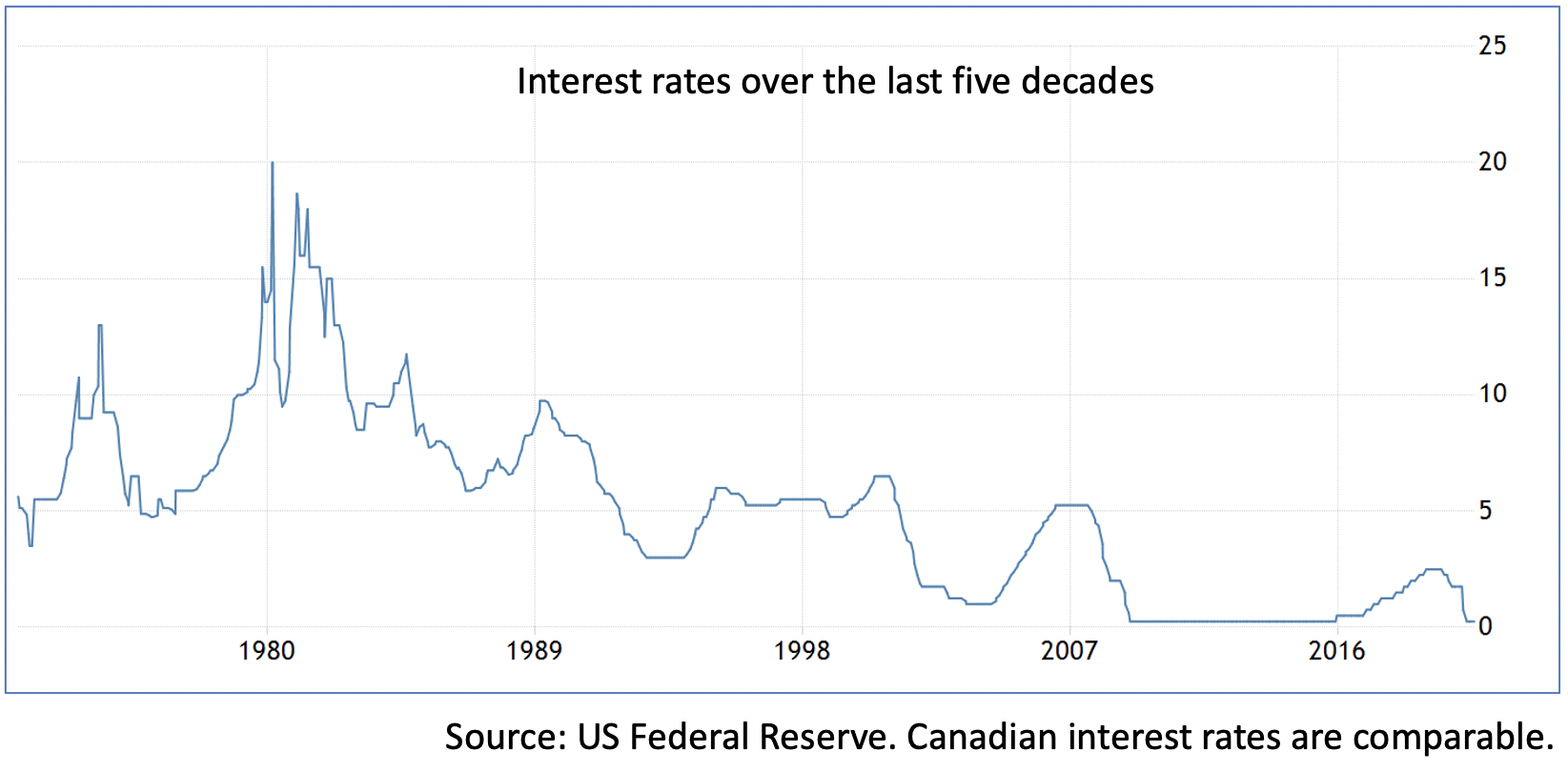

For people with these professionals’ earning capacity, there has never been a better time to be in useful debt regardless of what Shakespeare’s Polonius has to say:

Neither a borrower nor a lender be,

For loan oft loses both itself and friend,

And borrowing dulls the edge of husbandry.

Useful debt? Dulls the edge of husbandry?

The number of established companies and private businesses which operate without borrowed money today, is much closer to 0% than it is to 5%. The current borrowing environment is the best that it ever has been. Borrowing costs are equal to or less than the rate of inflation. If borrowing is tax-deductible, given today’s rate of inflation, low as it is, borrowing costs are actually at zero or less.

And husbandry? Established companies and private businesses are husbandry on steroids — working and thinking about the business 24/7!

But what if you are close to retirement or actually retired? The 6% plus interest on your savings which you remember from your youth, is a memory.

Today’s savings accounts can offer 1.05% interest but that will soon go below 1%. Further, lower interest rates will be with us for a long time. Younger people cannot save enough for a comfortable retirement. Retired people living off their savings face a serious longevity risk.

All of us must invest. Today, we can borrow for free. Let us use it to our advantage.

And the best place to invest?