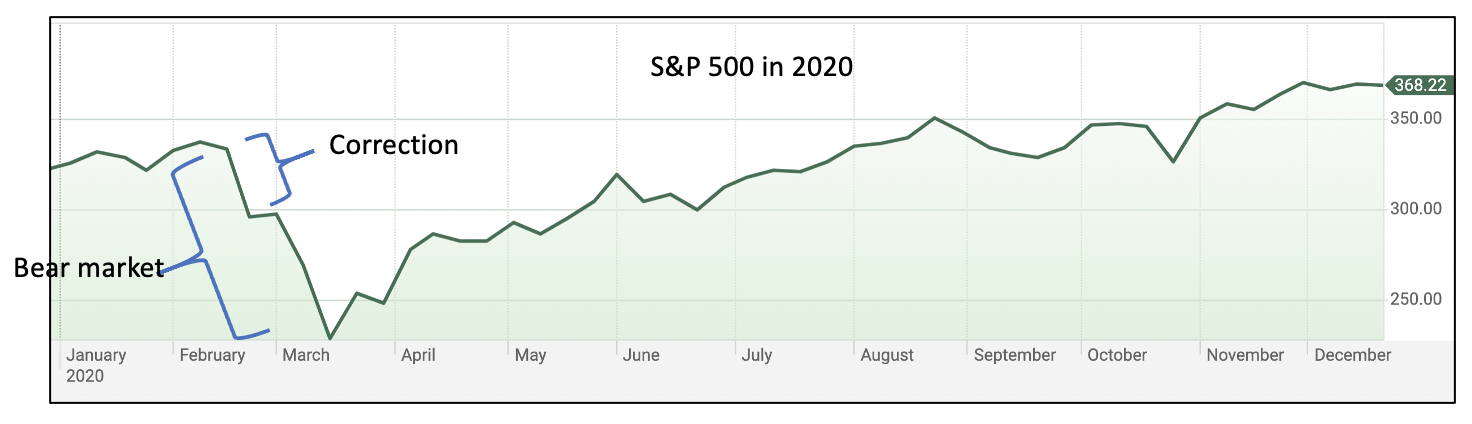

One of our members wrote recently stating that he was entirley in cash and waiting for a market correction in order to invest.

That is an example of market timing.

It might work out well, but the chances are that it will not. The Monday Morning program has a long track record of evidence-based success. The fourth habit that successful investors have is to buy and hold. Investors who have this habit do not try to time markets. They know that over the long run, investors, professionals included, even people who use a vast array of technical indicators, almost never outperform the market over the course of a market cycle because they have timing skills.

What about the opposite, that is, buying at the top? Many investors do exactly that! When markets are rising and expensive, they jump in, and at the opposite end, when markets are dropping and bargains abound, these investors head for the doors.

What do you think would happen if unlucky investors bought only at the very top, at the market peaks, say from 1970 to today?

Given certain conditions, these investors would be winners, big time! Really big!

And what are these conditions?

Number one is save regularly and keep the money in cash until the inopportune market peak.

Number two is do it yourself and avoid adviser fees.

Number three is buy a low-fee, index exchange-traded fund and nothing else.

Number four is buy and hold and never sell until retirement.

At retirement, withdraw 4% to 5% annually.

Do the first four look like the habits of Monday Morning millionaires? That is exactly what they are!

If these investors used the dollar-cost average approach to their savings, they would do twice as well.

“Time in the Market” and not “Market Timing” wins every time. This is an old wall Street wisdom.

We have designed the Monday Morning Millionaire Program to offer abstracted investment education. Over the last two decades, the program has outperformed over 90% of portfolios, including professionally managed ones.

The program does not provide any investment advice or endorsements.

Members can read our posts in less than five minutes. Following and studying the links embedded in these posts would take longer. How members manage a post depends on their level of interest and investing knowledge.