Investing is risky. Except for deciding whether to buy, sell or do nothing, we have no control over most aspects of investing. What control do we have over any individual security risk? Market risk? Sovereign risk? Currency risk? Regulatory risk? Property rights risk? Taxation risk? Black swan risk?

We do, however, have control over our savings rate and frequency and our asset allocation. Managing these two intelligently can produce satisfying results.

This post will look at saving.

Regardless of how we manage our portfolios, adequate saving is arguably the most critical element. Without it, nothing works.

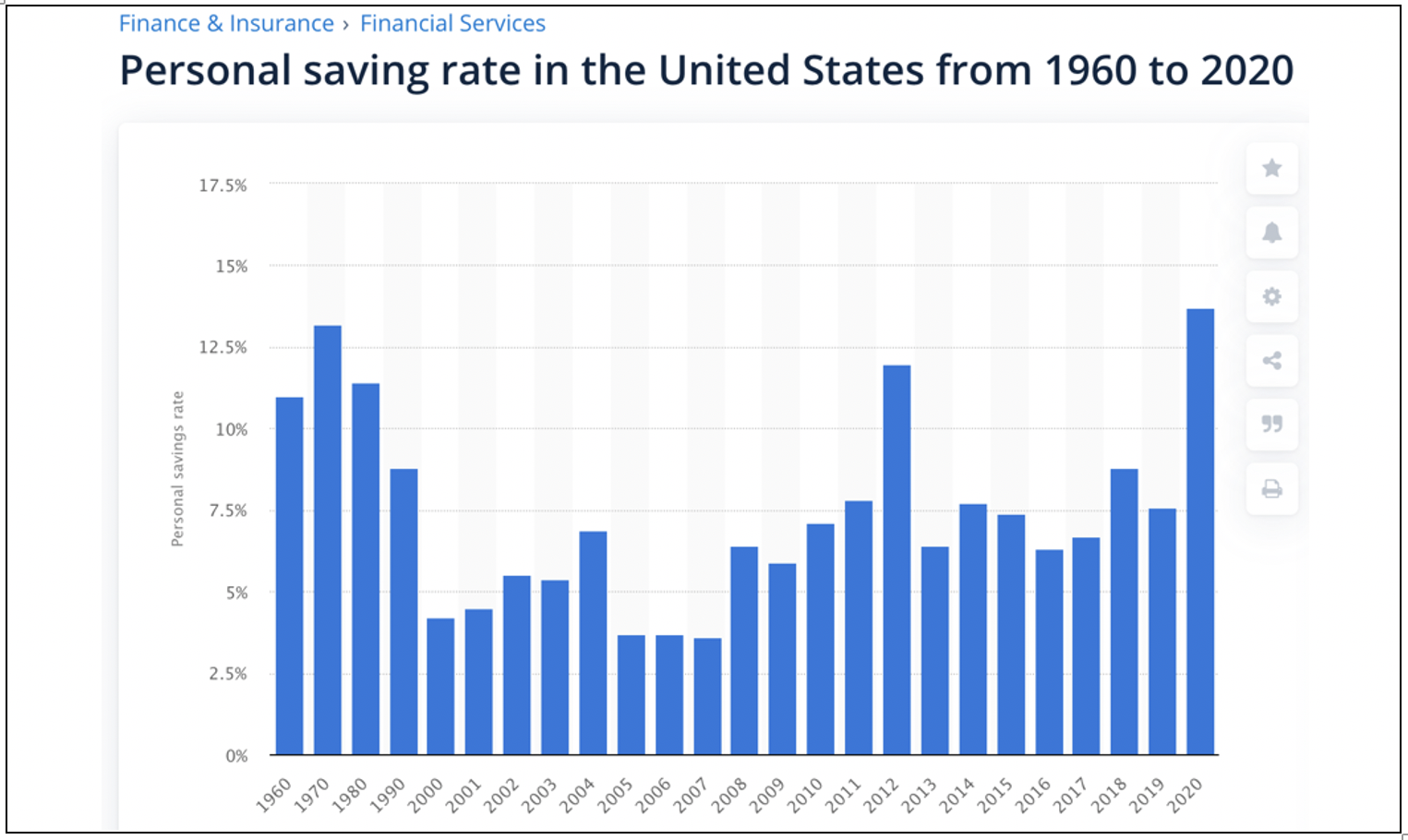

The 2020 personal savings rate is the highest that it has been in two decades.

However, according to the American Dental Association, 96% of dentists cannot retire at age 65 and maintain their lifestyle. The same likely applies to most self-employed people, that is, most business owners and professionals on Main Street. Government financial support and limited ability to spend money anywhere where groups gather explains why savings rates are so high.

Nevertheless, we can continue our working years’ lifestyle into retirement by saving and investing appropriately.

Some questions about saving arise.

- What is the right amount to save?

- Which is better, paying off debt or saving?

- Is paying down leases and business loans and thus building up the equity in our business the same as saving?

- Is paying down the mortgage on a home and building up the equity in it the same as saving?

Let us examine these issues individually.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us