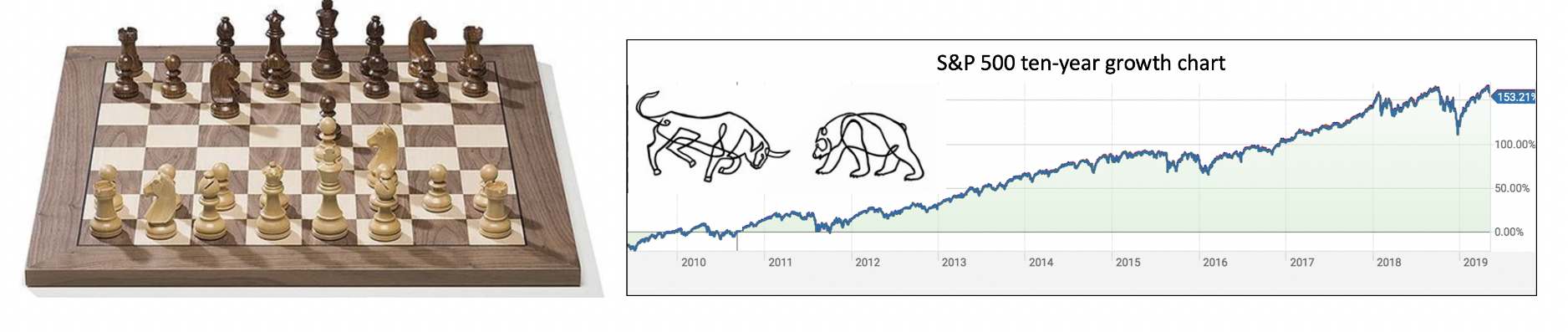

Chess and investing have interesting similarities and differences.

In chess, each player has 16 pieces. Each player has 20 possible first moves, 400 possible second moves, 197,742 third, and after three moves, 121 million. After seven moves, the number of possibilities is in the billions.

After that, the number soon increases to surpass the number of all the stars and planets and grains of sand on earth combined!

Well, guess what? The number of market choices is greater. Stock market, bond market, money market, foreign exchange market, options market, futures market, multiplied by the number of securities in each, multiplied by what investors can do with each — staggering! Incomprehensible!

In chess, a human player would ignore the vast majority of possibilities and focus only on the few that make sense. A chess-playing computer would assess all of them and play the single most promising one.

Investors similarly ignore most securities and select only a small number to study for buy/sell possibilities. Like in chess, a robo-adviser would assess a huge number of possibilities to make one buy/sell decision.

There is one important, major difference between chess and investing.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us