On March 15, 2019, from J……. C……. DDS, Lincoln, CA

Question:

Monday Morning Millionaire Program Answer:

While there are about 4000 publicly traded companies in the US, the S&P 500, consisting of only 500, represents the total market quite well since these companies are the largest ones. An interesting aside here is that the Dow Jones industrial index also represents the entire market quite well even though it is made up of only 30 stocks. They are the shares of well-selected, large companies.

The chart for VTI (Vanguard Total Stock Market exchange-traded fund or ETF) that you mention and the charts of the three ETFs which mirror the S&P 500 and which the Monday Morning Millionaire Program frequently refers to are identical. In the chart above, we see all four. It looks like one. All four are cap-weighted ETFs.

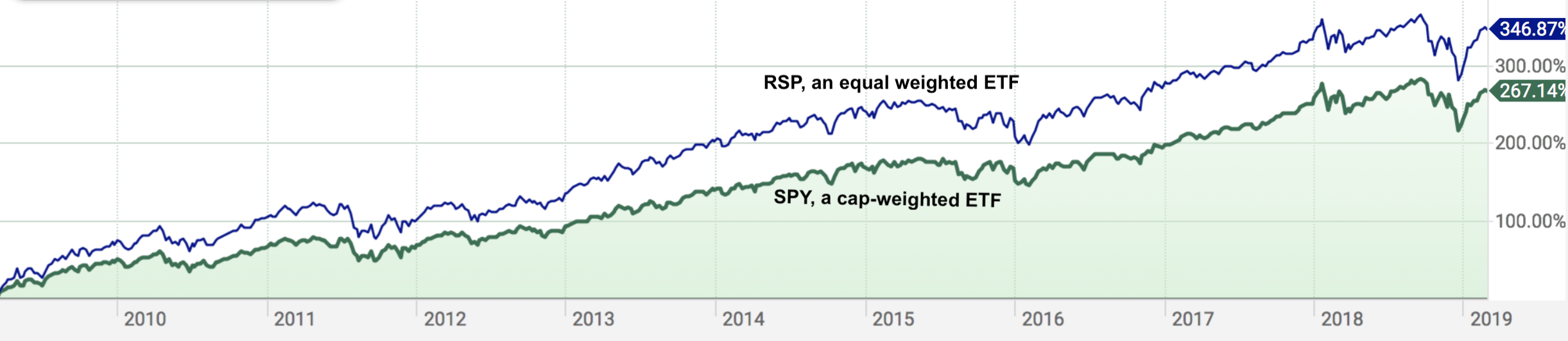

The ten-year chart below compares the Invesco S&P 500 Equal Weight ETF (symbol RSP) which is an equal-weighted ETF with SPY. We recently started promoting RSP as you can see in my personal portfolio which I reported on March 11 of this year. Spend a minute or two looking over that report.

If you compare RSP with SPY you will see that RSP is more recent and as a result, a good deal smaller than SPY, the largest ETF which mirrors the S&P 500. The RSP average daily and monthly volumes of trading are smaller and the expense ratio is more than twice as high. These issues concern institutional investors but we can ignore them.

If you are involved in options strategies, note that the SPDR S&P 500 Trust ETF (symbol SPY) and the iShares Core S&P 500 ETF (symbol IVV) have weekly expiry dates. Weekly expiry dates tend to have higher premiums.

The Vanguard Total Stock Market ETF (symbol VTI), the Vanguard S&P 500 ETF (symbol VOO) and the Invesco S&P 500 Equal Weight ETF (symbol RSP) have monthly expiry dates.

Concerning options strategies, the Monday Morning Millionaire Program recommends that members only sell and never buy puts and calls and that they do so in their fun portfolios only. Investors always make and never lose money selling puts and calls. However, they do give up the opportunity of making even more money if the underlying ETF rises above the selected strike price.

The underlying will fluctuate and investors will lose more money occasionally than the amount of the premium they get, but only in the short run. Investing should be a long run activity. It can be successful if we observe the habits of highly effective investors.

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us