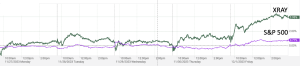

Gerald Loeb’s advice: “Put all your eggs into one basket and then watch that basket.” That basket needs to be an exchange-traded fund (ETF) tracking the S&P 500. Only a few qualify. SPY is the best. It is the oldest and largest ETF with the narrowest bid/ask spread.

In line with that advice, our fearless, intrepid investor was entirely in cash in the U.S. dollar. She decided on that a few weeks ago when the put/call ratio turned -ve.

As it happens, the U.S. dollar strengthened, and she did ver well.

What will she do when the market opens today?

YOU NEED TO LOGIN TO VIEW THE REST OF THE CONTENT OR LEAVE A COMMENT. Please Login. Not a Member? You can now sign up for $12 for a one-year membership. Join Us